I was doing a seminar in the Capital of East Dakota a few years ago.

When I walked into the meeting room a couple of hours before the event, I was surprised by the number of participants that were on the roster. Usually, in a city the size of Snagglepuss (the capital of East Dakota, as if you didn't know), I would have expected about 20 to 30 people. But the list showed almost 80 folks. This was pretty close to a record for me. I've only seen crowds of that size in Manhattan. And this wasn't Manhattan. Not even close.

I took a look at the roster again to see if I could find any reason for the big numbers and immediately spotted the cause. Almost 50 people were from one organization...the East Dakota Department of Revenue.

I groaned. It's never a good thing when someone from the tax department is at one of my seminars. It's not that they interfere. In fact, they are usually complimentary about the program. What drives me nuts is that everyone else in the seminar shuts up. There's virtually no interactivity, no questions, no comments...nothing! After all, who is going to ask a question about their sales tax issues when there's an auditor sitting in the front row? And the auditor isn't going to ask any questions - they don't want to look like they don't know about sales tax. So it turns into a really boring seminar for the audience.

In this case, I had not just one auditor, which is bad enough. I had 50 of them, far outnumbering the civilians in the room. It did not promise to be a good day.

And it didn't inspire confidence in the East Dakota Department of Revenue either. As a seminar presenter, you can tell if your audience is getting the material you're presenting. You see smiles of comprehension, knowing nods, and people ask questions to clarify points as opposed to "Can you explain use tax again?" In this class, I was looking out on close to 50 people who were clearly lost. There were a lot of dull stares coming from the auditor part of audience. Their lack of understanding was confirmed by the questions they were asking at the breaks. I felt like saying, "Wait a minute, you guys are sales tax auditors?"

You may be wondering how the civilian part of the audience was doing. I saw nothing but pure terror on their faces. And they kept making sidelong glances at the auditors that were sitting among them. Also interesting was how many of them had taken off their name badges.

During one of the breaks, I was chatting with one of the few auditors who I could see was getting the material and asking smart questions. I asked him, "Why are you guys here?"

He said, "Oh, this is our in-service training for the year."

I said, incredulously, "For the year???"

"Yep. There's not a big training budget"

"Who's minding the store?"

He said that this was only about one third of the audit staff.

Now think about this...

The price of this class was $200 per person. Even if they got a deal from the seminar company I was working for, they probably still paid $7000 or $8000 for those 50 people. And they were only a third of the staff.

For that same price, they could have had someone do a custom seminar for their

entire audit staff, not just one third of them. Instead they got a seminar not designed for them, but for businesses and taxpayers. And this one day general seminar was their only training for the entire year!!!

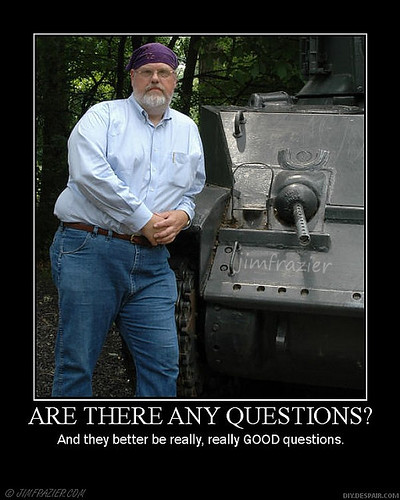

So there are two take-aways from this:

1. The auditors in your state may not be getting the training they need, so you should not assume they're always right.

2. The training department for your department of revenue may not be spending your money wisely.

Please keep in mind there are are lots of good, knowledgeable, and competent sales tax auditors out there. I have met quite a few. If you get one of these folks, your audit will be professionally conducted by a sharp representative of the state.

But there are a lot of dolts out there too. Particularly in East Dakota. I mean, they named their capital Snagglepuss!

By the way, other than the made up geographical names (which I'm having fun with), this is an absolutely true story.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the

disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Here's more information

Get these articles in your inbox - subscribe at

http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.