This article is based on a recent story about a retailer who kinda screwed things up. I’m not going to identify them, or give you a link to the original story because I’m going to severely mock them and I don’t need no trouble with no lawyers. Consider this fiction “inspired” by actual events.

1. The store has been overcharging their customers for nine months by 1 percentage point. The correct rate was 7% and the store was charging 8%. No mockery here…this stuff happens.

2. This is not just one store. There are several other stores in the chain. So I’d assume they have competent accounting folks. This, as it turns out, is a big assumption.

3. The extra money wasn’t paid to the state. The error was at the cash register, but they were remitting tax to the state at the correct rate. So they were holding on to all that overcharged tax. The owner wasn’t sure how much was over-collected, but estimated it was a couple of thousand dollars. Wasn’t sure? Does he have accountants, or monkeys with pencils?

4. A customer finally noticed the error (after nine months) and called the store. The assistant manager said there was no error, because the store was in a special taxing district; and that’s why the rate was a point higher than expected.

5. The customer then called the city and found out there was

no special taxing district. In other words, the assistant manager was, er…wrong. What a surprise.

6. The customer then called the store again and was told, again, that the store had not made a mistake. Amazing how much trouble those assistant managers can get you in. They’re OK for checking restrooms and time cards, but you really should never let them near the phone. And if a customer calls about the same issue

twice, maybe the problem should get escalated. I’ve never done much customer service training, but that seems like an obvious idea.

7. The customer called the local newspaper and

they called the store. This time the assistant manager awoke from his stupor and got the owner involved. Within an hour, the owner called the paper, admitted they had made a mistake, had reprogrammed the cash registers, and was pretty embarrassed about it. He guessed that the mistake was when the last rate change had occurred (which makes sense). Amazing what a call to the local media will do.

8. The customer (and me for that matter) can’t understand why it took nine months for anyone to notice this. It seems like there was a general ledger account that had a whole lot of extra cash sitting in it. Heck, I wasn’t the world’s most detailed-oriented controller, but even I would notice that.

9. The owner said he’d issue refunds to anyone with receipts (who keeps those for very long?) or who is signed up for the store’s rewards program, which tracks purchases. But the rest of their customers…there shall be no refunds for them.

10. The owner then said he’d donate the remainder to charity. But the state said, “Not so fast, buckaroo.” The law (which is pretty typical in most states) says that, if too much tax is collected, it must be turned over to the state. The state did say that they’ll refund him the money after he refunds it to the customers; if he provides proper documentation. But the state gets the money first, and the excess

stays with the state. Here’s a tip for the owner…before you start babbling to the media about a topic (sales tax) for which you obviously don’t have a clue, you might want to do some research. Or call those people with the letters after the end of their names.

OK, enough with the mockery. Here are three pieces of advice for those of you who collect sales and use tax from your customers. And these will be getting added to our

best practices webinar as well.

1. Balance!

Every month, someone in accounting should be reconciling the amount of taxes you collect to the amount of taxes you pay. This should be one, relatively easy part of the normal sales tax return preparation. Unless you’re really sloppy, I can’t imagine that this would take more than a few minutes.

There, was that hard? But doing this will avoid these kinds of embarrassing and tough to solve mistakes that will really tick off your customers. And you’ll avoid the press calling your boss. We don’t want that.

2. Double check when the rates change!

Whenever there is a rate change, expect that this kind of thing will happen. So check your sales for the first few days or weeks to make sure that

every system (or sales person’s price list, manual, etc.) has been updated with the

correct rate change. If you overcollect the tax, refund it immediately. Usually if you do it within the same month, the state doesn’t care.

3. Escalate tax issues quickly

Don’t let non-financial personnel make decisions or talk to customers about sales and use tax. They really don’t know what they’re talking about. And you probably want to get a sales tax pro involved quickly.

Remember, this is not an uncommon occurrence. Don’t let it happen to you.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the

disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Here's more information

Get these articles in your inbox - subscribe at

http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

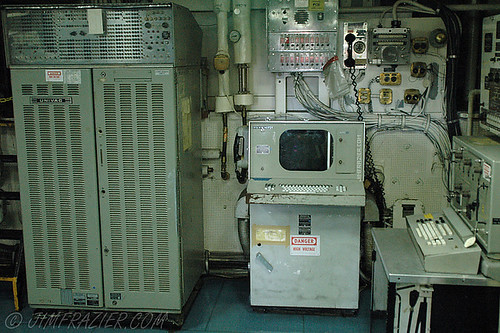

Picture note: the image above (I’m thinking that’s the assistant manager) is hosted on Flickr. If you'd like to see more, click on the photo.