This article first appeared back in 2007 and I thought it should see the light of day again.

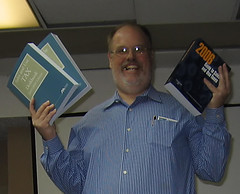

This article first appeared back in 2007 and I thought it should see the light of day again. These are sales and use tax books that I strongly recommend as reference tools. If you have to worry about a few states, you really should own them. If you are in only one state, they may be overkill, but are still worthwhile. Both books cover all of the states.

Guide to Sales and Use Taxes (from Research Institute of America)

This book has an enormous amount of information for each state, with the material broken up into 15 subchapters within each state chapter. It also has an opening chapter which is basically "sales tax 101." If the book is weak, it is in two areas: there aren't any citations, and it sometimes provides too much data with too little interpretation. These deficiencies are made up for in the next book.

Sales and Use Tax Deskbook (from the American Bar Association)

Each state's treatment is written by an attorney who specializes in that state's sales and use taxes. While I've only met a couple of them, I heard of many more. So far, they have all been heavy SUT litigators and highly "plugged in."

The book actually provides less detail than the Guide (above), but does provide more interpretation of the laws, as well as citations. So you can read the basic information, then drill down to the statute, regulation, bulletin, court case, opinion letter, etc.

Here are two particularly useful items provided by the book:

1. It gives you the rules for taxation of exports out of the state. Now you'll have ammunition for your discussions with vendors who are charging you their state's tax as opposed to the correct one (yours).

2. For most states, the book shows the "drop ship" rules, which will, again, help with vendors who really don't understand this particular topic.

I actually recommend both books if you have the budget.

First of all, owning both books gives you the ability of second sourcing or even third sourcing your research. It's always helpful, on confusing issues, to see if the books agree.

The other reason is updates. By owning both books, you can flip-flop your purchases. One year get an updated version of the inexpensive book, next year get the expensive one, and so on.

Finally, you'll notice I'm not offering to sell you these books. That's because I want you to trust that I'm not biased here. I'm not recommending them to make money. Contact the publishers and they'll be happy to sell them to you.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment