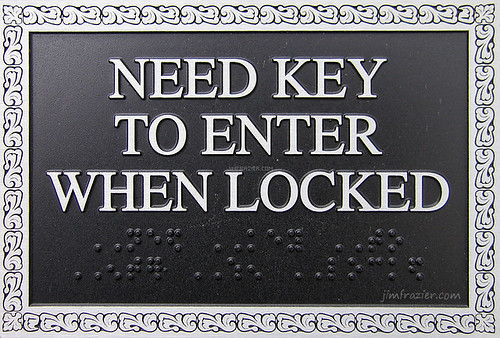

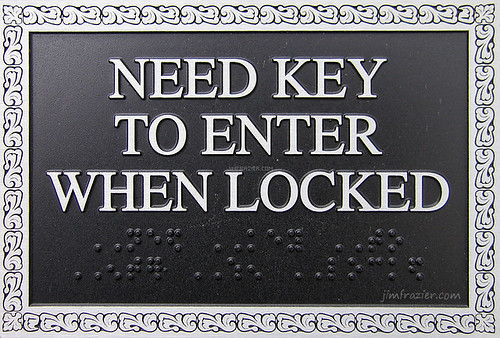

From time to time, I come across just plain stupid rules that pretty much make no sense. You know they wrote the law with absolutely no thought to whether it made sense or not. I'll also classify this under stupid politician tricks, because, well, they are.

From time to time, I come across just plain stupid rules that pretty much make no sense. You know they wrote the law with absolutely no thought to whether it made sense or not. I'll also classify this under stupid politician tricks, because, well, they are.

---

In

Missouri, over the counter drugs are taxable, which is the case in most states. But for disabled persons they're exempt from sales tax, but only if the right paperwork is filed. Here's the relevant law:

"Sales of over-the-counter drugs when sold to an individual with a disability or to the individual's agent are exempt from tax. When selling over-the-counter drugs to an individual with disability, the retailer should obtain a purchaser's signed statement of disability. The retailer should retain these statements for three (3) years. The statement should include the purchaser's name, type of purchase and amount of purchase, and be signed by the purchaser or the purchaser's agent. The retailer should request a form of identification, such as driver's license, credit card, etc. to verify the identity of the purchaser."

It's good to take care of disabled people. But why not just make it simpler by saying that OTC drugs are exempt for everyone? Some states do this. And, as an effort to make sales tax less regressive, it's probably a good idea. But, come on! Only a career bureaucrat, or your standard-issue politician, could think this kind of paperwork is a good thing. Oh, wait, I remember now...Missouri is the "show me" state. So I guess they want to be "shown" that the buyer has a disability.

By the way, I've never seen the above law, or anything like it, in any other state. And I didn't find any definition of "disabled." So I guess Missouri didn't want to "show me" that part. It's also not clear whether the disabled person has to provide this documentation every time he buys a bottle of aspirin, or whether or not he only has to file once.

I'm guessing the politicians did this to be able to say that they gave a benefit to the disabled, but made the benefit so hard to exploit that there really was no loss of tax revenue. They do that a lot. See Minnesota's Capital Equipment exemption.

---

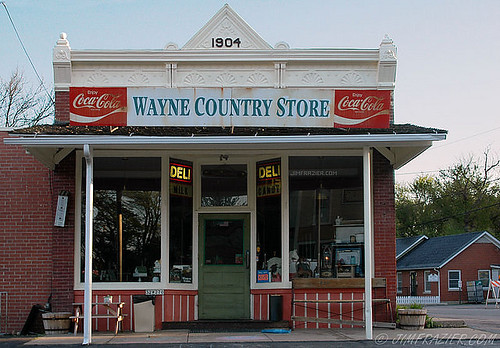

Let's continue to pick on Missouri...

In many states, there are exemptions for fund-raising sales by non-profit organizations. Generally they're restricted to an annual dollar amount, a small number of events per year, or a few days per year, usually less than a week or so. In most cases, the rules would cover most of the non-profits and churches I've been involved with.

But in Missouri,

all sales by non-profits are exempt from sales tax, as long as the proceeds fund the mission of the organization, which you'd expect. Let me repeat the key phrase here...

all sales - for the entire year!

Now, again let me say that I have nothing against non-profits. Some of my best friends are non-profits. But making all of their sales exempt seems like Missouri is giving away the store. Don't they have budget problems like every other state? And before you start spluttering...keep in mind that taxing non-profit sales doesn't mean you're taxing the organizations themselves. Since the tax is added to the bill, the tax is merely being passed on to the customer. As long as the organization does it correctly, they have no financial burder, other than filling out the return and keeping a supply of pennies handy.

And if you're going to say that this would interfere with their funding, keep in mind that the vast majority of states don't grant a year-round exemption! They grant a limited exemption to cover occasional fundraising events. But, in Missouri, if the hospital runs a gift shop, those sales are exempt all year. Why can't the gift shop charge tax like every other gift shop in Missouri?

Hey Missouri politicians! Need some money? I got your money right here!

---

Moving across the Mississippi River, let me now talk about

Illinois.

Where to start? Illinois is an insanely complicated state. I attribute this to the low IQ's of most of our politicians (I live here so I'm partly to blame) and their complete inattention to the effects of the laws they pass. Maybe the fact that many of our governors and miscellaneous government officials wind up in jail has something to do with it too.

Anyway, our rocket scientists in Springfield came up with something called the Manufacturer's Purchase Credit (MPC). This is another one of those laws that appears to only exist in one state - Illinois. Don't these dopes talk to the dopes in other states? Because this one is just plain sad.

In most states that have lots of manufacturing, exemptions are granted for equipment and supplies (I'm seriously over-simplifying). In Illinois though, you earn a credit for the tax you would have had to pay on the equipment you get tax free under the manufacturing exemption. And you can apply that credit against your supplies.

First of all, most people just can't get their head around this concept. "Wait a minute, I'm getting a credit for taxes that I

would have paid? And it's only 50%? And what the hell are these forms?"

There

is a lot of bookkeeping involved and and complicated reports that have to be filed. I wouldn't be surprised if only a fraction of manufacturers understand this well enough, and have the bookkeeping skills, to take full advantage of this.

Wait a minute. Maybe they

were talking to Missouri (and Minnesota) after all! Sneaky suckers!

---

Finally, we come to

Massachusetts. These jugheads passed a law a couple of months ago to tax computer services. While other states

do tax this, it's not a good idea for a state that is trying to position itself as a high-tech hub (ya see, that's because "high-tech" usually involves computer services). That last comment was for any politicians that might read this. The rest of you knew what I was driving at.

Anyway, at the time, there were lots of protests against this tax, but the legislature passed it, and the governor signed it. They ignored the rabble because they're politicians, and they don't have to worry about what people think until the election. And who cares about the businesses anyway? And then the howls really began. And the politicians realized that the election really wasn't that far away. After a couple of months, the legislature repealed it, almost unanimously, and the governor signed it. You can almost see the tails between their legs. Oops.

I will give these lunks credit for recognizing their mistake and fixing it. But they were still stupid to pass it in the first place. Do you politicians even read the laws? Or if that's too much, maybe an executive summary of the law? Or think ahead?

If you'd like to read more, here's a nice summary of what took place.

http://www.wickedlocal.com/carver/topstories/x1843589170/STATEHOUSE-ROUNDUP-Saying-oops-on-tech-tax

So here are the take-aways:

1. Politicians aren't terribly smart, but they might just be devious enough to pass an exemption granting a benefit, but making it difficult to take advantage of that benefit.

2. Or they're just dumb.

And to any politicians that actually read this, I didn't mean you. You knew that, right? Still pals?

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer on the right.

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com

and there's more sales tax news and links here

http://salestaxnews.blogspot.com

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.