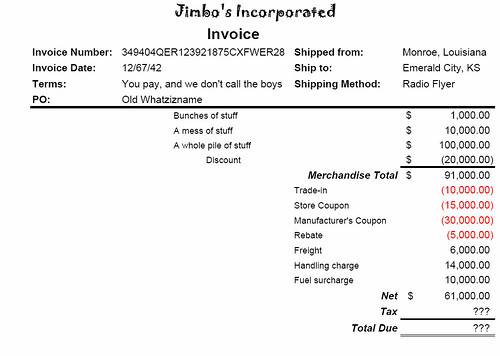

This article was originally written in August of 2007. I recently reviewed it and it still is correct!!! But I thought I'd add a few additional items.The taxability of freight or delivery charges is one of the most frequently asked questions. And the rules vary all over the place. In more than half the states, freight charges are taxable. This means that you would add the charges to the merchandise total in determining the basis for the tax calculation.

This article was originally written in August of 2007. I recently reviewed it and it still is correct!!! But I thought I'd add a few additional items.The taxability of freight or delivery charges is one of the most frequently asked questions. And the rules vary all over the place. In more than half the states, freight charges are taxable. This means that you would add the charges to the merchandise total in determining the basis for the tax calculation.This means that, if the sale is taxable, then the freight will be taxable in those states. But if the sale is not taxable (eg. manufacturing equipment or resale), freight isn't taxable.

Here are some additional points. Remember though, that whether or not freight is taxable is only a question if the sale is taxable.

1. If the seller is actually separately showing his inbound freight (the freight the vendor pays to acquire the property), then that charge is usually included in the basis - it's taxable. For freight charges to be non-taxable, they can only be for shipments from the seller to the buyer.

2. In states where shipping charges are NOT included in the basis, there are usually restrictions. Here's a laundry list of the possible requirements. Note that these are highly variable:

- Is the freight charge separately stated? This is universal. For shipping charges to be non-taxable, they must be separately stated on the invoice.

- If the sale terms are FOB origin, then the freight isn't taxable. Does the ownership transfer at the shipping point?

- The seller can't make a profit on the delivery charge: the charge better be pretty close to what the carrier actually charged the vendor. If the seller's freight charge is more than the freight he paid, the freight charge is taxable.

- Did the seller ship via common carrier or in his own vehicle?

- Does the buyer have the option of arranging their own shipment or going and picking up the goods at the seller location?

- Was the freight charge separately agreed upon? In some states, having it be on a separate line on an order form is enough. In other states, it must be a separate physical contract. In other states, it depends on the precise wording of the agreement. If there's any restriction that is a highly gray area, this is the one.

Please remember that this is a taxing policy that is highly variable from state to state. You need to research this carefully.

Then there are those "easy" states who just say "Is the sale taxable? Then the freight is taxable." I love those states.

The Sales Tax Guy http://salestaxguy.blogspot.com

See the disclaimer on the right.

Don't forget our upcoming seminars and webinars. http://www.salestax-usetax.com and there's more sales tax news and links here http://salestaxnews.blogspot.com

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.