This is one taxing policy that usually comes as a surprise to participants in my seminars.

This is one taxing policy that usually comes as a surprise to participants in my seminars.In many states, janitorial services, particularly for commercial clients, are taxable services.

Here's the problem. Many janitorial companies don't charge their customers tax, probably for two reasons:

1. They don't know they're supposed to charge tax. I'm guessing this is pretty common because, in my experience, janitorial services are often small, family run businesses who don't have an office staff and therefore aren't up to speed on the finer points of sales and use tax laws. And they don't come to my webinars.

2. They know their services are taxable and they absorb the tax. In other words, they're paying the tax to the state, but they're not showing it separately on the invoice. Absorption is very common. One of the reasons it's done is to avoid arguments with customers.

Maybe your cleaning company is Big Galaxy of the Universe Janitorial Services. They are actually paying the sales tax to the state and have folded that into what they bill you. They do this because, whenever they try to charge their average customers sales tax, the clients scream, "What the heck? What in tarnation are you doing! Why are you charging me sales tax?"

Absorption is illegal in most states, but rarely enforced. But the problem for you is that, now that you know janitorial services might be taxable, you might accrue the tax without realizing that the vendor has already taken care of it. You just don't have the invoice showing it, so you don't know for sure.

There are also fine points to be aware of with regard to this taxing policy. Some states allow you to exclude the cost of the labor, leaving just the overhead and profit as being taxable. And other states don't say that janitorial services are taxable. But they might say that cleaning of fabric is taxable. Since most offices have drapes, carpeting, furniture, etc., that says that some portion of the janitor's services are taxable.

Your job is to research the rules in states where you purchase this service and determine if it's taxable and in what way. If the vendor isn't charging you correctly, ask them why. If they've absorbed the tax, get them to give you a corrected invoice.

If they didn't know, consider this a teaching moment for them. If they still won't charge you tax, then accrue. Or find a service that will charge you tax properly.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Here's information on our upcoming seminars and webinars.

http://www.salestax-usetax.com/

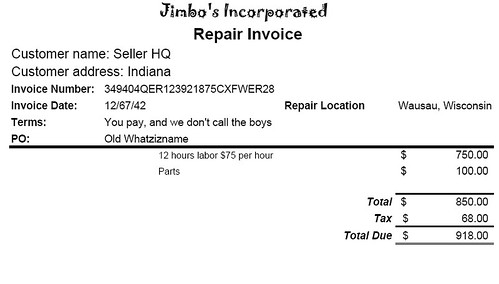

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.