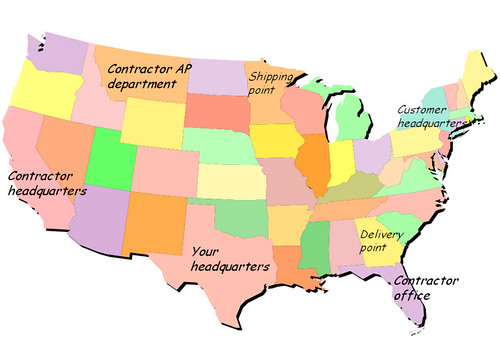

The question is at the top of this article. Here's my poor attempt at an answer:

When you buy a car from a dealer, they are going to charge you sales tax on the sale of the car. I think we all kind of understand that. Easy. Unpleasant, and maybe a surprise, but nevertheless - we get it.

When you buy a used car from a dealer, they are still going to charge you sales tax on the sale of the car. "Whoa," you say, "what are you talking about? It's used! Sales tax already has been paid on that car."

It doesn't make any difference. You see, a common misconception is that sales tax is on the item being sold. It's actually on the sale itself. That's why it's called a sales tax. That car might keep getting traded in, and every time a dealer sells it, it's subject to sales tax.

However, there is another way you can buy a used car - from Jim on Craigslist. That's how I sold my 1997 Pontiac Grand Prix**

I put an ad on Craigslist and someone called within a couple of hours and handed me cash later that day. And I, as the seller, didn't have to charge Joe sales tax. And before you ask "why?" I'll tell you. Because I was making an occasional sale (often called a casual sale). These are sales by sellers who are not in the business of selling the item being sold. Since I wasn't in the car sales business, I didn't have to charge tax on the sale of Eleanor (yeah, I called her Eleanor).

That's also why you don't have to charge tax when you have a garage sale - you're making an occasional sale.

But here's the thing. Cars are probably the most expensive thing that most of us will ever buy that's not real property (like a house). The state doesn't want to give up the sales tax just because Joe didn't buy the car from a dealer. But they also have trouble imposing the responsibility of charging the sales tax on me because I'm probably going to screw it up. Since I don't sell cars very often (like once every 20 years), I'm unlikely to know about a rule that says I have to collect the sales tax. So most states have an alternate plan. They collect the tax when Joe registers the vehicle and gets his new plates. Joe, of course, is surprised and complains about it on an internet forum. ***

So I, the seller, am off the hook. But Joe is in for a surprise when he goes to the DMV.

Finally, it's a technical matter, but the type of tax changes when you pay the state when you register the car. Sales tax is a tax on the sale of the car. But when the state can't impose tax on the sale, they have this other tax that plugs that loophole. It's called "use tax." This is a tax on Joe's use of the car. Some states will properly call it use tax. But others will call it a sales tax just so that Joe doesn't freak out thinking that the state is just making up taxes now.

* Yeah, I know the more usual word is "forums," but I just like the way "online fora" sounds. Trust me, I'm not trying to be a word snob. I'm not an elitist - I'm right down there with the rest of you people.

** I loved that car. It's the only car I've ever had where girls actually thought it was cool. Not me of course, but the car. Loved that car.

*** See, I can use regular people words too!

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/