If your company typically makes taxable sales, then you probably have Angelina's problem.

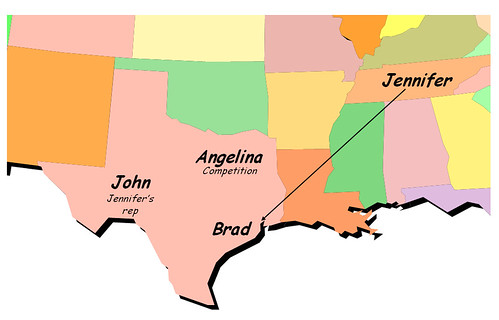

Angelina has been losing sales for a while to Jennifer. She and Jennifer sell the same thing, at a similar price. But Jennifer isn't charging Brad sales or use tax on her sales to him, or anyone else in Texas. Why? Because Jennifer doesn't know that she's supposed to charge Texas tax on those sales.

Now I'm giving Jennifer the benefit of the doubt. She may actually know that she is supposed to charge Brad tax. She may choose to ignore the fact because, if she did comply with Texas law, she'd lose lots of sales (and probably have to fire John). But I'm pretty sure that Jennifer is a good guy, so let's just say that she is one of the thousands of small to medium size businesses who don't understand these rules.

If you're a new reader, and one of the aforementioned thousands, the reason Jennifer has to charge Brad tax is because she has nexus in Texas. John is her sales rep and John's physical presence in the state brings her under Texas' jurisdiction. And they require that she charge her customer "use" tax on the Brad's use of the equipment that she sent to him in Texas.

But Angelina is smart. She just took one of our seminars. So now she knows that Jennifer is supposed to be charging tax, which would eliminate Jennifer's competitive advantage. Brad would no longer have a reason to buy from Jennifer, and would buy from Angelina. If both Jennifer and Angelina charged Texas tax, then they would be on equal footing and the competition would be fairer.

So Angelina picks up the phone, writes a letter, or sends an email along the lines of:

Dear Texas Comptroller of Public Accounts:Assuming Texas is doing their job, and there are no guarantees, they will contact Jennifer and probably audit her, assessing massive back-taxes, interest and penalties.

Jennifer is based in Nashville, Tennessee. She ships to many Texas customers, and is not charging them the Texas use tax. I happen to know that she has nexus in Texas, because I've run into John, her sales rep, on several occasions. I frequently see him in client offices and at trade shows. I've even had lunch with him where I found out that, while not assigned full-time to Texas, he spends at least six weeks a year here, and he's done it for over ten years.

I'm loosing a great many sales to Jennifer who's only competitive advantage is that she's not charging the use tax that she should be imposing.

Please take action to "educate" her about her responsibilities to the great state of Texas.

And Brad will come back to Angelina, who will be snickering to herself when Brad's not looking.

Here's the important part. If your company has a problem similar to Angelina's, where you have out of state competitors who aren't charging tax in your state, but you know they have nexus, then rat 'em out! Hey, this is war!

The only thing that prevents companies from doing this is that they don't know they can. Sales and marketing people know virtually nothing about sales and use taxes, which is actually kind of ironic. And because of this ignorance, they don't know that there actually is a way of dealing with those out of state vendors who are stealing the business.

If you're like most people who read this blog, you're in accounting or purchasing. This just might give you something you can bring up at the next interdepartmental meeting to help solve a problem. You're usually making trouble for sales. Now you can help them.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Here's information on our upcoming seminars and webinars.

http://www.salestax-usetax.com/