The following is a true story. I've randomly changed the names, states and products so that nobody, least of all me, will get in trouble. But it had to be told.

I received a call from one of my previous class participants on Wednesday. Doris had emailed me a question the day before, but it was so long and involved that I wanted to talk about it on the phone. I had a long drive in Chicago morning traffic, so she called me back at the perfect time.

Doris had sold some boxes to Sam in Idaho. The boxes were containers for Sam's product so they were bought for resale and Doris had Sam's resale certificate. Doris had billed Sam, with no sales tax on the invoice, since it wasn't taxable.

But then Doris got a call from the Sam's distributor in California. For some reason, they were going to pay the bill. Here's the conversation:

Distributor: I have your invoice here for the boxes you sold to Sam. Why didn't you charge sales tax?

Doris: It's not taxable. They're boxes for his products so they qualify as exempt.

Distributor: No they're taxable. You need to rebill us with California sales tax.

Doris: You're wrong. They're not taxable. It's called the "container exemption." I'd be happy to send you more information.

Distributor: I need to have California tax on this invoice.

Doris: But I can't bill you California tax anyway. We aren't registered in California, don't do business in California and don't have nexus there. I can't collect taxes for a state I'm not registered in. Besides, the delivery occurred in Idaho, therefore it would be Idaho tax anyway. But it's not taxable!

Distributor: If you don't charge me California tax, we'll just add the tax to the payment.

Doris: If you do that, I'll just have to send you a refund check. We can't accept that money.

Distributor: We won't cash it.

At this point, Doris, realizing she was talking to a tree stump, gave up and sent me the email.

After we went through the whole thing, Doris asked, "I'm right, aren't I?" I said, "Absolutely! The best chance you have is that the person who handles the refund check won't have heard from this idiot. They'll deposit it and that'll be it. Out of curiosity, what part of accounting was the person from?"

Doris replied, "She was the sales rep."

"Ah. Now it makes sense."

If there's anyone who'll stick to their guns, on a topic they know nothing about, in the face of someone who clearly knows what they're talking about, it's a sales rep. (I kid, I kid. I spent years in sales)

I explained to Doris that she needed to keep very detailed notes on this situation because of two potential scenarios:

1. The California distributor gets audited by the state of California who discovers that taxes were paid to Doris. The auditor will ask Doris what she did with the money, since she's not registered in California. Doris will need to be able to document that she did refund the money.

or

2. The California distributor hires a reverse sales tax auditor who comes across this weird invoice where they paid extra California taxes for a shipment of non-taxable items to Idaho. [Boy, as soon as I wrote that, I knew I had the title of this article.]

The auditor will immediately call Doris and demand a refund for the overpayment. Again, Doris will need to be able to document the refund.

Now the other thing that the sales rep didn't know about (and many of you probably don't know either) is that refusing to cash the check doesn't really solve the problem. After about a year or so, depending on the state, it will become an unclaimed property issue. Doris will have to send a letter to the company telling them they have an uncashed check. If they still refuse to cash it, Doris will then turned the money over to the abandoned property department of the state. Her job will then be finished. The money has been paid, in this case, to the state.

Now, when that reverse sales tax auditor calls about the overpayment, Doris can just say, "Yeah, that company you're working for refused the payment. We had to turn it over to the state treasurer. Call them. Not my problem anymore."

But, as I said, Doris needs to document the heck out of this. Because she'll be lucky if this doesn't pop up again in the next three or four years.

And here's a message for sales people, or any non-accounting folks out there. If the accounting people seem to know what they're talking about, there's a chance they do. I'm just sayin'.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

Education and training on state sales and use taxes.

We focus on the laws, as well as your systems, policies and procedures to assure compliance.

There are a couple of jokes, too.

Showing posts with label Sales and Marketing Hints. Show all posts

Showing posts with label Sales and Marketing Hints. Show all posts

Friday, March 04, 2011

Monday, February 14, 2011

A Sneaky Sales and Marketing Trick - Revisited

Listen up sales and marketing people. Since I'm currently working on educating you, here's an important tip that I wrote back in June 2010.

If the following conditions are happening to you, you really, really need to read that article.

1. Do you have an out of state competitor who regularly steals business from you because they don't have to charge tax, but you do?

2. Do you know, or at least suspect, that they have nexus in your state?

3. Are you sneaky and nasty? Actually, that's kind of a silly question if you're in sales. I kid.

Then take the steps mentioned in this article. You probably didn't know you could do these things (neither do most accounting types, so don't blame them), but depending on your state's laws, you can at least make some trouble for that competitor.

Enjoy.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

Wednesday, February 09, 2011

Sales and Use Tax for Sales and Marketing People

OK, for the record, I used to be in sales. I've had several careers, and I spent 12 years in sales and sales management. And I now own my own company, which counts as sales too. So I know from where I speak. I'm not just some guy from Accounting trying to make your life miserable.

Well, actually, I am trying to make your life miserable. But that's a side benefit. You see, I've never lost my accounting roots.

There are a few things that you folks need to know about sales tax. First of all, it's a SALES tax. Doesn't that sound like something you that you should be familiar with?

This project is going to take more than one article to cover, so I'm going to start with the most important points, and then add links to additional articles as they get written. I'm sure your accounting people will forward you the link whenever an article pops up. In the meantime, you can subscribe to this blog (see the box on the right at the top of the column) or you can follow me on Twitter. I actually post other stuff besides sales tax on Twitter. Like Dilbert.

Here are the first two points, and they're closely related.

If you have offices, warehouses, property or even people in a state, then you may have to start collecting taxes on stuff you sell and ship there. Even if your people don't live in that state, or maintain an office in that state, you may have "nexus" in that state. You may be required to charge that state's tax on what you deliver there, and follow their rules on what's taxable and not taxable.

This may be disappointing for you because one of the major reasons you're making sales in that state is simply because you always thought you didn't have to charge tax. Bummer. Now you do. You're going to have to start working harder.

Which brings up another problem. What you think is taxable or exempt isn't the way it is there. Every state taxes things differently. For example, let's say you sell computer equipment and you're based in Chicago. You send your sales people and installers up to Wisconsin on a frequent basis, but you don't maintain an office there. That is, unless you consider the passenger seat of your sales rep's car to be her office.

You now have nexus in Wisconsin. Which means that everything you deliver in Wisconsin needs to have Wisconsin tax imposed.

But wait, there's more (salespeople love that term, don't they?).

You know all that service and installation work you do in Wisconsin? You should be charging Wisconsin tax on that too! Wait a minute! You're thinking that repair labor charges and installation charges aren't taxable. They aren't. In Illinois. But you're in Wisconsin now, bub. And they are taxable there. See what I mean about it being different there?

So to recap: you can make your company subject to the jurisdiction of another state by having facilities, people or property in the state. In other words, a physical presence in that state. When this happens, you have nexus in that state. And then you have to collect that state's tax and follow their rules, which are probably completely different from the rules in your state.

Here's another example, then I'll send you on your way.

In most states, contractors pay sales tax on the building materials that go into the job. This is the case in New Jersey. But New Jersey has a "flow-through" exemption. This means that if they're doing a project for a non-profit organization or a government agency, the construction contractor can get an exemption for the sales tax on the materials for that particular job.

But Pennsylvania doesn't have a "flow-through" exemption. And many contractors from New Jersey get jobs in Pennsylvania. And they bid on the jobs assuming that there is a flow-through exemption. They didn't know it's different there. Then they start having materials delivered to the job site in Pennsylvania and discover that it's all taxable! And they have now underbid the job. I hear about this every time I do a seminar in New Jersey. Contractors are getting burned on this all of the time.

Always remember, it's different there.

Ok, you can now go back to making sales. But stay tuned. There will be more articles written just for you (and anyone else who finds them useful)

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

Labels:

Master Article,

Sales and Marketing Hints

Friday, June 25, 2010

A Sneaky Sales and Marketing Trick

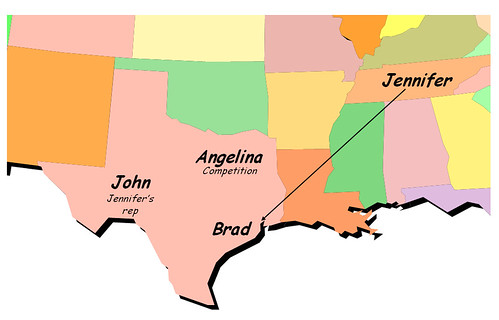

If your company typically makes taxable sales, then you probably have Angelina's problem.

Angelina has been losing sales for a while to Jennifer. She and Jennifer sell the same thing, at a similar price. But Jennifer isn't charging Brad sales or use tax on her sales to him, or anyone else in Texas. Why? Because Jennifer doesn't know that she's supposed to charge Texas tax on those sales.

Now I'm giving Jennifer the benefit of the doubt. She may actually know that she is supposed to charge Brad tax. She may choose to ignore the fact because, if she did comply with Texas law, she'd lose lots of sales (and probably have to fire John). But I'm pretty sure that Jennifer is a good guy, so let's just say that she is one of the thousands of small to medium size businesses who don't understand these rules.

If you're a new reader, and one of the aforementioned thousands, the reason Jennifer has to charge Brad tax is because she has nexus in Texas. John is her sales rep and John's physical presence in the state brings her under Texas' jurisdiction. And they require that she charge her customer "use" tax on the Brad's use of the equipment that she sent to him in Texas.

But Angelina is smart. She just took one of our seminars. So now she knows that Jennifer is supposed to be charging tax, which would eliminate Jennifer's competitive advantage. Brad would no longer have a reason to buy from Jennifer, and would buy from Angelina. If both Jennifer and Angelina charged Texas tax, then they would be on equal footing and the competition would be fairer.

So Angelina picks up the phone, writes a letter, or sends an email along the lines of:

Dear Texas Comptroller of Public Accounts:Assuming Texas is doing their job, and there are no guarantees, they will contact Jennifer and probably audit her, assessing massive back-taxes, interest and penalties.

Jennifer is based in Nashville, Tennessee. She ships to many Texas customers, and is not charging them the Texas use tax. I happen to know that she has nexus in Texas, because I've run into John, her sales rep, on several occasions. I frequently see him in client offices and at trade shows. I've even had lunch with him where I found out that, while not assigned full-time to Texas, he spends at least six weeks a year here, and he's done it for over ten years.

I'm loosing a great many sales to Jennifer who's only competitive advantage is that she's not charging the use tax that she should be imposing.

Please take action to "educate" her about her responsibilities to the great state of Texas.

And Brad will come back to Angelina, who will be snickering to herself when Brad's not looking.

Here's the important part. If your company has a problem similar to Angelina's, where you have out of state competitors who aren't charging tax in your state, but you know they have nexus, then rat 'em out! Hey, this is war!

The only thing that prevents companies from doing this is that they don't know they can. Sales and marketing people know virtually nothing about sales and use taxes, which is actually kind of ironic. And because of this ignorance, they don't know that there actually is a way of dealing with those out of state vendors who are stealing the business.

If you're like most people who read this blog, you're in accounting or purchasing. This just might give you something you can bring up at the next interdepartmental meeting to help solve a problem. You're usually making trouble for sales. Now you can help them.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Here's information on our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Labels:

Nexus,

Sales and Marketing Hints

Subscribe to:

Posts (Atom)