"How do we tax SaaS* services"

This question came up in a

webinar yesterday (thanks, Heather) and, after Googling it, I thought I'd share the tiny bit that I've learned, my brilliant solutions, and some relevant articles.

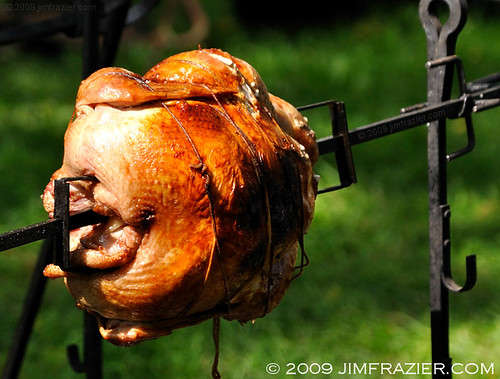

Essentially, there isn't much published on this. There are some articles that pretty much say the same thing: there isn't a lot of law to get your teeth into. As with most new technology, the states are taking their time catching up. Some of them are still trying to deal with downloaded software! And only a few have ventured into downloaded content, like music and movies.

But I have come up with two solutions to the problem. and you're not going to like it.

Solution 1 - Rental

1. I think that the closest existing type of transaction that would cover Software as a Service (SaaS) is software rental. Think about it. That's really what is going on.

2. Downloaded software is treated like

TPP in most states and therefore taxable.

3.

Rental of TPP is taxable in most states.

4. Therefore, SaaS should be treated as the rental of software and should be taxable in states where downloaded software is taxable, and rental of TPP is taxable.

5. Don't do this! Hold off, at least until you've chewed this over with your

sales and use tax consultant. Heck, your own state may not take this position, and therefore why self-assess when they wouldn't. But from a theoretical sense, this seems to be the answer.

Solution 2 - Tax SaaS as a service

Alternatively, if we consider SaaS as a service, then it gets stickier.

In states that tax data processing services (not many), SaaS would seem to be taxable. That's easy.

With other states, they'll probably have to start passing laws. Which, given the

amazing skills of our politicians, will take some time. Get back to me in 20 years.

Where is it taxable?

The next question is, since it's in "the cloud" how does any given state tax it?

Where is it taxable? There seems to be a lot of hand-wringing about this. But I think that this has already been dealt with, to a degree. Whenever a taxable service is performed in one state, but the buyer receives the benefit in another state, it's usually taxable in the state where the buyer receives the benefit. This isn't absolute, and I'm short-circuiting a lot of theory, but that seems to be the way that it usually works out.

For example, if you're in a state that taxes

alarm monitoring services (many do), and you hire an out of state company to provide that service, the purchase of the service will usually be taxable in your state because that's where you're receiving the service. Either the seller collects the tax if they have nexus, or you self-assess use tax. But it's still taxable.

So, if you're using SaaS, and if the service is taxable based on one of the above methods, it'll probably be taxable in the state where the benefit of the service is received. Seems simple to me.

Selling SaaS

What about companies that sell SaaS? Well, if you have

nexus in states that have figured out how to make this taxable, then you're going to have to start collecting tax. Welcome to the business world. Of course, if Congress makes it easier for states to create nexus for you, that's not good. But quit whining. It just means you'll have to hire at least one more accountant. Speaking as an accountant, that's not a bad thing.

Nobel Prize

I've just given everyone a guide to solving this SaaS / Cloud Computing problem. So when will I be picking up my Nobel Prize for Sales and Use Taxes?

Links

Here are a few articles I found on the subject. I didn't go deep in my search, so if you wish to mine the web further, please do so.

brianstrahle at Accountingweb.com February 2010

forum discussion at softwareceo.com March 2006

Gene Hoffman at http://blog.vindicia.com April 2010

Jeremy Aber at aberlawfirm.com September 2010

grantthornton.com - there are a couple of links within the article too

*Ya gotta love an acronym made up of upper and lower case letters. Credit must be given to the techoids that came up with that one.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the

disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details that haven't been discussed, and every state is different.

Here's more information

Get these articles in your inbox - subscribe at

http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.