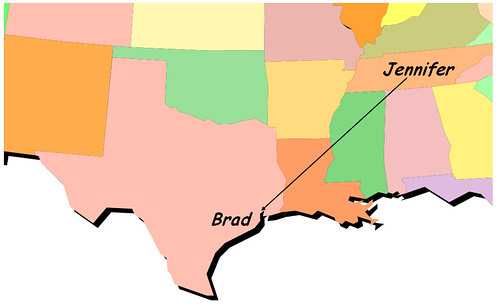

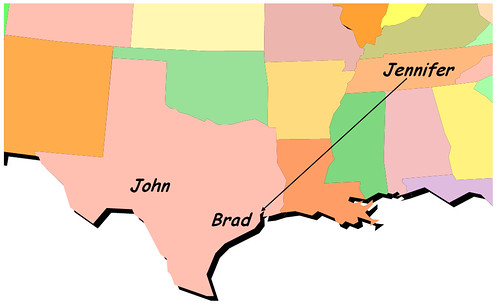

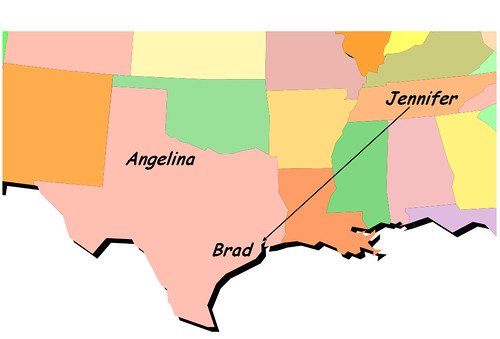

I picked up this story a couple of years ago. We'll use Virginia and Pennsylvania for the states, but those are not the real states involved.

The company in Virginia got audited by Pennsylvania for

nexus. It turns out that they

did have nexus, never realized it, and the auditor nailed them for a couple of

hundred thousand dollars. The taxpayer understood they had really screwed up, so the audit wasn't as confrontational as it sounds like it ought to be.

During the audit, she asked the auditor, "How did you guys find us?"

The auditor was feeling expansive.

"You know how when you go into a diner, there's usually a box sitting on the cigarette machine or by the cash register with entry forms. You know, where you might win a fabulous, all-expenses paid trip to Disneyworld?"

"Yeah."

"Well, one of your employees filled out the entry card. The card asks questions like, address, employer, job title, etc. It also sneaks in a couple of other questions, like how often do you visit the state, and whether or not your visits are business related.

"Your employee gave your company name, said he was a sales rep, visited Pennsylvania 12 times a year, and the visits were business related. Your employee gave us everything we needed to determine that you guys have nexus in Pennsylvania."

"OK, I get that. But how did you auditors get that information?"

"Because we ran the contest."

OK, I left a few extra lines there to let you think about that for a moment.

The Commonwealth of Pennsylvania was smart enough, and sneaky enough, to front a couple of thousand dollars for a contest in order to collect information from anyone who spends time at a diner. Obviously most of the responses would be worthless, but they are going to find a few nuggets of gold.

What amazes me is that the politicians and bureaucrats would be smart enough, but also adventurous enough, to do this. This takes some real creativity to come up with something this sneaky. My hat's off to them.

By the way, please remember, this isn't Pennsylvania. That's just the state I've been using. It could be

your state. And I'm not telling.

So you might want to tell anyone representing your company that, when they travel, not to enter those contests.

The Sales Tax Guy

http://salestaxguy.blogspot.comSee the disclaimer - this is for education only. Research these issues thoroughly before making decisions.

Here's information on our upcoming seminars and webinars. Don't forget, we just announced our February to April schedule!

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

These are the news links I've posted on Twitter for the last week:

These are the news links I've posted on Twitter for the last week: