My bad. I'm starting to get more questions via email. Which is OK. Feel free to do that. But I wanted to give you a more convenient place to post something, whether it's a question or comment. Maybe other people will have an answer that's better than mine. I've got a link to this post in the left column, so you can always find it. And please note the disclaimer as well.

One request though. Please don't look at this as "Jim's Law Look-up Service." If a question gets posted along the lines of, "Is freight taxable in Georgia?" then my response will be, "Did you check Georgia's web site?"

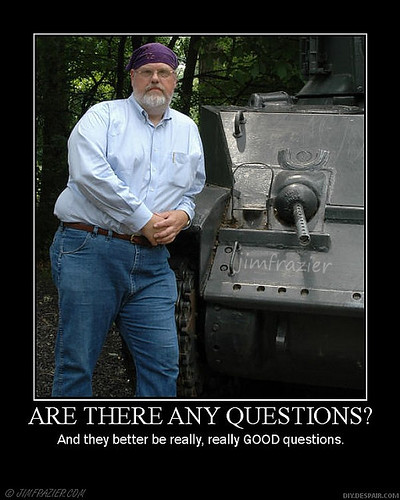

And it doesn't have to be that good of a question.

Sales Tax Guy

| Here's information on our upcoming seminars and webinars |

| And please don't forget to visit our advertisers! |

Picture note: This was shot at Cantigny, a garden and military museum in the western suburbs of Chicago. I spend a lot of time volunteering there. And improving my people skills.

52 comments:

I have a client that provides computer training for corporations. One of their customers would like to have catered meals at 29 of their locations provided during their training sessions. Should my client charge sales tax on the markup (outside restaurant will provide meals) or charge a separate service fee.

State of operation NC

Thank you

This is the general rule, not NC rule. Use this information to check further with the state or expert (see disclaimer). The states generally prefer for you to buy from the caterer for resale (and not pay them any tax). Then you charge tax on the full amount when you charge your customers. Charging tax on the markup theoretically gets the state their money, but I've rarely seen it officially sanctioned other than to settle a weird problem.

It's a shortcut and I don't like shortcuts. Do it right and you'll have less problems.

Better yet, let the caterer bill directly.

Thanks Jim

That makes perfect sense

Tomika

We are a 501(c)(3) organization. If we give a 'free' gift valued at $15.00 in return for a $25.00 donation to our organization, is the $15 gift subject to sales tax or use tax? We did not pay sales tax on the purchase of the $15 item.

If use tax is applicable, I'm asssuming it would be cheaper than 'selling' the item as a fund raiser for $23.36 + 1.64 sales tax = $25 (7% tax rate) Or should we just have our vendor charge sales tax on the $15 item to begin with?

We are trying to keep as much $$ as possible for our scholarship fund - and still do it legally.

Sorry I'm late on this one - what state are you in. This varies enormously from state to state. Not sure I'll be able to answer your questions even with that info, but it'll help.

Jim

I have a contractor (Cleaning Service) who is based out of NJ. He provides service work only as we buy the supplies for 3 of my facilites approx 300,000 sf. His invoices list his monthly fee plus NJ sales tax. The work is performed in PA. He also charges sales tax on 100% of the monthly service fee. I recently bid the work out and other contractors only charge sales tax on 37.5% of the monthly price. Why the difference in sales tax and should a NJ based company be charging me PA sales tax rate or NJ sales tax rate if the work is performed in PA?

Usually, services are taxable based on where they are performed. Since the NJ contractor is performing the services in PA, and it's taxable in PA, he should be taxing the services under PA rules.

PA allows janitorial services to only tax the non-labor component of the bill which is why you're seeing the other contractors charging less...they know they can. The NJ guy doesn't know that.

Also, make sure, if you use them, that the NJ guy actually is registered to collect PA tax. It's a common mistake for them to collect the NJ tax for services performed in PA. You won't get credit for having paid the wrong tax.

Also, there are some t's that need to be crossed and i's that need to be dotted for the reduced PA tax to apply...check the rules to make sure you do it right.

Jim

Sales Tax Guy

Read the disclaimer

Any suggestions on Sales Tax software programs? Our acct

program (we are a material supplier / subcontractor) does not do the job. Thanks.

Not really. I hear various comments from folks, but since I don't use any software myself, it wouldn't be right to make recommendations. I'd suggest, though, that you read my article here http://salestaxguy.blogspot.com/2005/06/faq-how-do-i-find-sales-tax-software.html

My company is located in NJ and has retained the services of a telemarketing company located in NY. Our vendor did not charge us NJ sales tax. Would this transaction be subject to NJ use tax? I would think not since it a service occuring in another state. However, would you please help clarify? Thank you.

Probably not taxable. Double check to see if NJ mentions this as a taxable service, but I've never seen that one taxed before. I know NJ has been talking about taxing more services, so it's worth checking to be sure. And NJ auditors are mean. ;-)

I am building a home on a lot that I own in Florida on a cost plus basis with a general contractor. The (gc) builder forwards the invoices from his suppliers and subs and I write a check to the builder for that amount plus his percentage. I am also billed for supervisory fee's, insurance, shipping, etc. Should I be paying the builder the sales tax or only for the materials? If I am to pay him sales tax, should I be charged his percentage on the sales tax portion of those invoices. I don't think sales tax should be part of the "cost" and am confused interpretting the FL Dept of Rev definitions. Thanks!

Interesting question. Since this involves big amounts, I'd really recommend you contact an accountant or lawyer who knows their way around sales and use taxes.

Generally, there is no sales/use tax liability by you to the contractor in the kind of arrangement you have. He's not performing a taxable service, nor is he selling you taxable materials.

If his billing to you simply is the invoices for the materials with the tax on them as shown by the lumber yard, then you probably should pay that, since it represents his costs. But don't pay any additional sales tax.

Again, I'm just trying to give you some guidance. Talk to a local pro.

If you'd like me to send you a good article on this from my online database, email me at info0801@takechargeseminars.com

Any suggestions on the sale of tax software programs? please... thanks

Nope. I haven't been in the "real world" for a number of years, so I couldn't give any recommendations that I'd feel comfortable with. However, I've written about the process of buying software here. This might help.

http://salestaxguy.blogspot.com/search/label/Buying%20Systems. If the link doesn't work, go to the index section on the left and find "buying systems"

Jim

I am Fla. based printing company. I sold a job to a company based in NJ. They are "reselling" it to a CT. University. However they are a service company and do not have a resale certificate. Do I charge them sales tax? If so, how much? If not, do I need to get any documentation from them? Thank you!!

Lemme make sure I have the situation...

1. You're in FL

2. You've shipped to a customer in NJ. You did NOT deliver it and the customer did not pick it up.

3. They're buying it for resale to a company in CT.

4. You don't have any people representing you, in any capacity, either as employees or contractors in either CT or NJ. You also don't have any facilities or any property that you're storing in those states.

If *everything* above is true, you probably don't have to charge any tax. It's not taxable in FL because you're shipping it OUT of FL. And you have no responsibilities in NJ or CT because you don't have nexus there.

But I may be missing something. So check it out yourself. See our disclaimer.

http://www.salestax-usetax.com/disclaimer.htm

Thank you Jim. I appreciate the quick response.

In New Jersey, a small business owner told me that if I write the check out to her personally, I do not have to pay New Jersey sales tax? Is this legal?

I actually did pay her in this way many times, and am now thinking about it (I probably should have thought about it BEFORE I paid her). If I report her to the State, can I get in any trouble for paying her this way?

It's not legal. She's evading tax, and so are you. Talk to your CPA or lawyer to take the next step. Your vendor is just trying to understate her sales and her sales tax liability. But if you don't pay tax to her, you owe tax to the state directly. Talk to a pro.

I have a promotional products company in Jersey. I am writing up a quote for a company in Florida, do I need to charge them sales tax? This matter always confuses me.

Thanks -

First, where is the delivery going to occur? That will determine the state that has jurisdiction. The next is whether you have nexus in that state. Don't answer that fast. You may have nexus and not owe it.

Promotional materials are usually taxable, so if you have nexus in that state, you probably need to charge that state's tax (and file returns in that state).

Contact me and we can discuss further.

I have an electronics repair business in NY where customers ship their damaged device in for repair, primarily via USPS, from all over the country. We also sell and ship parts to all states in the US via USPS. My question is, do I need to collect sales tax from NJ and CT under the tri-state agreement or should / can the customer be paying this on their end?

Thank you in advance.

Check NY's web site to see what it says about repairs of goods that come into the state and that will be sent out of the state. If you have nexus in CT or NJ, then you'd probably have to collect taxes from those states.

You might have nexus because you go over to those states to do work on big equipment, make sales calls, deliveries, etc.

Just checked my tax database and it doesn't mention the "tri-state agreement." What do you mean? Post a link, please.

I own a office cleaning business in NJ. I am writing a proposal for a client in Rockland county, ny. Do i need to charge them sales tax?

Take a look at the NJ web site to see if they list your services as taxable.

my services are taxable for my customers in NJ. According to the website, since the contract will be signed in NY, and the work will be performed in NY I shouldnt be collecting sales tax. Plus I am not selling them a product plus I dont have an office in NY or NYS employees.

Sorry, I missed that the client was in NY (you didn't capitalize it so my eyes just blew past - grin).

If you're going to performing work in NY, then you have to check the NY web site to see if it's taxable.

In most states, service is taxable based on where it's performed or the benefit is received. If you're doing taxable work in NY, then you may have to worry about their taxes.

Jim

Hi,

Ours is a financial services company headquartered in MN and have office locations in many states. We proure security & survilliance systems from an electrical contractor. All the systems are first sent to our headquarter for programming and then later on shipped to the state where the security system is to be installed. The vendor then get the system installed at that location using his own workforce or through a subcontractor. The vendor is self assessing MN use tax on all goods supplied to us and paying that to the MN state. Now my questions are:

1. Do we owe sales/use tax in the state where the system gets installed?

2. Can we take credit of the use tax paid by the vendor? If yes what documentation we need to maintain for audit?

3. Can we issue a direct pay permit to the vendor?

Thank you

Sorry it's taken so long to reply. You posted your question on the first day of our vacation and I had explicit orders from my wife....

Anyway, if you're still around, I have questions:

1. Is the vendor who sells you the equipment the same one who takes responsibility for installing the equipment, either with their own staff or through a contractor.

2. Do you take possession and title to the goods when they are sent to you for programming? Do you then ship the equipment to the final destination, or do you return to the vendor who does this? How long do you have the equipment in your possession for programming?

3. When does the vendor bill you for the equipment? When they ship it to headquarters or after it's installed at the remote location? And is it lump sum or do they separate the cost of the equipment from the labor?

Hi Jim,

I have a question regarding how much sales tax I should be charged for my online purchases from a major retailer with physical stores located in my state (IL) and city (Chicago), headquartered in a different state, though. The orders are shipped from different states as well, not sure if that makes any difference. From what I was able to find, it should be 6.25% and I'm looking to confirm this rate. Thank you in advance.

I'm not really in the business of "confirming rates"...particularly in Illinois where it gets messy. However, if the delivery was in Illinois, than it would definitely be an Illinois issue

6.25% is the state rate, but whether you would owe local taxes, and WHAT local taxes, depends on the location of the seller, as opposed to where you are.

Hi I am starting a cleaning business in G.A. My question is do I charge taxes for my services?

Easy answer. Look at the sales tax section of the GA web site. The should be a publication that gives you the answer. There may either be a general sales tax book, or an industry specific publication. Either way, the answer isn't hard to find.

I am a life coach in Pennsylvania. I coach people in various states and in Europe via phone or skype. Are these services taxable? What about if I physically go to a client location in PA or another state? Thank you so much for sharing your knowledge.

There are a few states where what you do might be taxable. You need to research those states and see.

If you go to those states and do the work, then you should be charging and remitting tax.

And if you do the work online, after having been in those states, you may have nexus and have to collect and charge tax.

Can't speak for other countries.

And see the disclaimer.

Following up on that previous question, I posted a blog article that fleshes out my answer even more

http://salestaxguy.blogspot.com/2014/07/life-coaches.html

Hi - I am a carpet cleaner in NJ and have just contracted to provide carpet cleaning services in New York. What are my sales tax collection and filing obligations? My understanding is that carpet cleaning services are tax exempt in NY, while they are subject to tax in NJ. Any help would be greatly appreciated.

Hi - I am a carpet cleaning service provider registered in NJ. I recently contracted to provide services in NY. Can you tell me what my sales tax collection and filing obligations are as they relate to this particular service? It is my understanding that carpet cleaning services are exempt from NYS sales tax, while the service is taxable in NJ. Any insight would be greatly appreciated.

Have a look at this page:

https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/st/quick_reference_guide_for_taxable_and_exempt_property_and_services.htm

I found it by googling "carpet cleaning new york sales tax"

Jim

Thank you! I guess the heart of my question is whether or not I have to file anything with NJ like a use tax or anything like that. I believe from what I have read that I would not be required to file sales taxes in NY and I would not be required to charge or file any NJ use taxes - but want to make sure I am not missing anything when I invoice the customer and file my taxes

thank you Jim! I guess the real question I have is will I be responsible to NJ for any tax liability? I am registered and licensed in NJ, but providing the service in NY. The service is taxable in NJ but not in NY. If I am interpreting everything correctly, I believe I do not have to collect and remit sales tax in NY because the service is tax exempt, and I also would not be subject to a NJ use tax or cause the NY customer to be subject to a NJ use tax because the service is provided in NY, but I want to be sure prior to invoicing

I can't help you "make sure." Unless you use a lot of equipment, have an office or have property in NY, you probably won't owe use taxes. And there's always the possibility that you're selling something incidental to your business that may require you to charge tax. The only way to make sure is to learn more until you fully understand sales tax in NY (as well as NJ).

Thank you so much!

The company I am at manufactures commercial refrigeration for sale/re-sale. If my company no longer has a presence in a state that we used to collect sales tax and process a sales tax return, do I still have to collect sales tax and process the tax return?

Good question - and there have been a few articles written about this topic. Have a look at these

http://salestaxnews.blogspot.com/search/label/Trailing%20Nexus

Jim

I am a life coach in NY state.

1. Are my client phone calls taxable?

My understanding is NO, based on this statement from NYS "Sales of services are generally exempt from New York sales tax unless they are specifically taxable." and the list here:

https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/st/quick_reference_guide_for_taxable_and_exempt_property_and_services.htm

2. What about clients who reside in other states or countries? If I am doing phone sessions, do I need to go by their sales tax laws? Or since I am based in NY state myself, do only NYS tax laws apply?

Thank you!

Erica

1. I don't believe so, particularly given the list. In fact, while it's not something I typically research, I don't believe life-coaching is taxable in the vast majority of states.

2. In other states where what you do is taxable (I'm guessing HI, SD, WV, and NM might be worth investigating), the question is whether or not you have nexus in those states. If all you do is provide phone consulting, then you're probably OK. BUT, things are changing. States are getting more aggressive, and there is pending federal legislation that could change things as well.

However, unless you're in the Zig Ziglar category, you're probably not generating enough revenue to hit thresholds that may be put in place.

The other thing is watch what you do that may create nexus. For example, do you send your clients ANY material, like books, papers, cd's or dvd's where you retain ownership? Do you participate in trade shows, seminars, etc.

I used to work for a national seminar company. If you use that as a platform to promote your coaching business, that could be a problem.

See the disclaimer on the right.

Jim

Hi Jim,

I saw this article regarding new sales tax laws in Colorado and thought I'd share it with you in case you were interested. Not sure if this means more sellers will eventually become compliant or if more sellers will just adhere to the bare minimum... Also, if I am understanding this right, Amazon requires sales tax compliance in Colorado, although it is one of the 23 states that does not require Amazon to do so, why?

Let me know what you think!

http://bit.ly/2189dD6

Thanks, Jim!

Austin

First of all, I caution anyone to be careful about clicking on the link - I distrust any link that doesn't show where it's going.

Anyway, there has been a lot of coverage of this issue lately. Here's a link to the "co" keyword on our news blog.

http://salestaxnews.blogspot.com/search/label/State%20CO

Basically, the courts have said that, while CO can't make Amazon and other remote sellers collect tax, they can force them to do reporting. So, if you live in CO, the state will know what purchases you made from larger out of state vendors.

Think of this in the same way as 1099's.

And here is a likely reason why Amazon is collecting taxes in CO

http://taxify.co/blog/2016/02/04/amazon-begins-collecting-sales-tax-in-colorado-what-does-it-mean/

Jim

Jim

Post a Comment