I was doing only my second seminar EVER on sales and use taxes. It was Manhattan and this woman comes up to me at the first break. I had talked about

personal liability of officers in the previous section and she looked worried.

"Hi, I just started as the CFO for a company here in New York, and I found out that we've been selling a lot of stuff to a company in Texas for years, and charging them sales tax. But we haven't been filing Texas sales tax returns."

"Well, that's not the end of the world," I said. "Mistakes happen. I assume you have been remitting that money to the state of New York?" That's typically the way it works. Many people make the error of charging tax for deliveries in a remote state, but report those sales on their local return. Nobody's going to jail for that. Penalties and back taxes, yes. Striped pajamas? No.

"Well, actually, we haven't paid the taxes to anyone," she said. "That's how I found the problem. I was going through the general ledger and came across this account for Texas Sales Taxes Due."

"How much is in there?"

"One hundred and fifty-three thousand dollars."

My wife tells me I don't hide my emotions well. I must not have in this situation because she asked me, "Is this bad?"

"OK, let me make sure I understand this. Your employer has been shipping stuff to a company in Texas for a long time?"

"Yes, about eleven years."

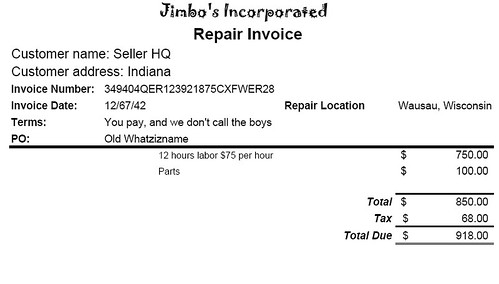

"And they have been charging Texas taxes. And showing this on the invoices?

She nodded, "Yes, I looked at some of the recent invoices and they show 'sales tax' right on the invoice. It looks like the Texas rate too."

"Are they still doing this? Making sales to Texas, charging tax and letting it sit in that liability account?"

"Yes."

"Just out of curiosity, is this a small, entrepreneurial company where the owners have put pretty much everything into the business?"

"Yes."

"Hundred and fifty thousand?"

"Yep."

"And you haven't paid this money to Texas, or even New York, right?"

"Right." I really do remember this conversation like it was yesterday. It's firmly planted in my brain.

"OK. Final question. Are you really the CFO or is that just the title they gave you?" This happens, folks. They might have given her the CFO title, but not actually make her an officer of the company. I once was a "sort-of" CFO.

"Yes, in fact we just took care of the paperwork last week."

I took a deep breath. "Mary," her name was Mary, did I mention that? "You should probably leave the seminar now. You've learned enough for the day. I'd strongly recommend that you get this resolved, and you should talk to your own attorney. You're an officer of the company. Even though you weren't around when all of this happened, the longer you're on board, knowing what's still going on, the more likely you're going to be in deep trouble. You may wind up holding the bag."

The problems are:

1. The customer gets audited by Texas who discovers that they've paid all this tax to a company who wasn't registered in Texas. Texas makes the customer pay the money all over again, plus interest and taxes. The customer probably has a good case for

fraud against Mary's company. They charged them tax and didn't remit it to

any state. For eleven years!

2. Texas may decide to go after Mary's company, particularly if they had nexus in Texas. I didn't ask Mary about Nexus.

I've read more than a couple of stories where, in a start-up situation, the owners put their life-savings into the business, and then some. When the business fails, they've got nothing to make good on debts - like a sales tax liability in Texas.

But the CFO probably doesn't have any skin in the game. And Mary has some money. She's got a house, car, maybe a vacation home, and a 401k that carried over from another company. And she's an

officer of the company. She really might be the only one left with any money when the dust settles after this company goes out of business. There have been cases...

As she left, I was really hoping she'd talk to a lawyer.

She emailed me a few days later.

Hi, Jim,

I quit the job. I went in to my boss' office the next day and said, "we really need to talk about this Texas tax liability." He said, "Mary, it would be a really good idea if you never brought this up again. Ever." I realized that I didn't want to work there anymore. I figured if he had a problem with just one thing like that, what else was lurking? And as the CFO, I didn't want to be associated with that kind of business.

Thanks, MaryThe moral of the story? There are two.

First of all, sales tax seminars can be more interesting than you'd think.

Secondly, if you're an officer of the company, you have some serious liability for your company's "mistakes," whether it's sales tax, payroll taxes or some other problem. Beware.

By the way, a couple of years later, I was chatting with an executive with the audit division at the Texas revenue department. I told him the story. After shaking his head, he asked hopefully, "You don't happen to know the name of either of those companies, do you?"

"Nope," I smiled. "My

seminars are kind of like confession. What's said in the seminar, stays in the seminar."

And if you're wondering, the dialogue and facts are as true as I can remember. But the states, cities and Mary's name were all changed to protect the extremely guilty.

Sales Tax GuySee disclaimer and research the issues thoroughly before making decisions

Here's information on our upcoming

seminars and webinars And we do

coaching!And please don't forget to visit our advertisers!

Picture note: the picture above is hosted on Flickr. If you'd like to see more, click on the picture.