A variation on this question came up in a telephone conversation yesterday. And it comes up so often, that I apologize to all of you for not addressing it sooner.

Here's the scenario:

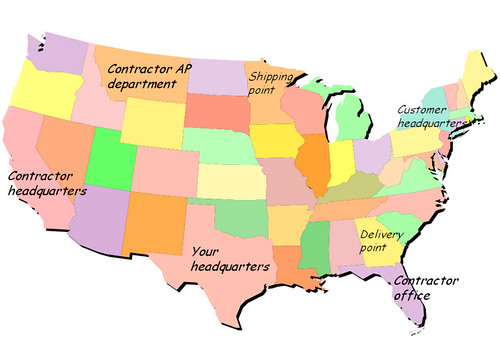

Your company is headquartered in Austin, Texas.

The customer is headquartered in Albany, New York.

The contractor, who has been hired by the customer, orders the goods from you while sitting in their field office in Jacksonville, Florida.

You ship the goods from your manufacturing plant in St. Paul, Minnesota to the job site in Folkston, Georgia.

The contractor is headquartered in Redding, California.

The contractor's AP department is in Helena, Montana.

Which state gets the sales tax or use tax?

Here's a hint.

It isn't New York, Texas or California. The location of the corporate headquarters is so irrelevant, it isn't funny.

It's not where it was ordered from. Again, not relevant.

A very common misconception is that the billing address is somehow important. It isn't. AP folks often screw this up and base their assumptions on the taxing rules in their state. And since Montana has no sales tax, that must mean that everything the contractor buys is not taxable. Right? Wrong.

Another common mistake is to tax the transaction based on where it was shipped from. Wrong. The ship from state is irrelevant.

By process of elimination, we've narrowed it down to one state - Georgia. And that is the state that has jurisdiction. Because they are the state where the goods were received and taken control of by the buyer. And since it was an interstate sale, there can't be any sales tax. So use tax is owed to Georgia by the buyer.

Unless...

...you have nexus in Georgia. Maybe, for example, you have an engineer who regularly visits job sites in Georgia to help spec out projects and assist with installations. Then you'll have to bill the Georgia use tax on the invoice and remit the money to Georgia. Even though you're in Texas.

But no matter who has to pay the tax, the only state that gets the tax is Georgia. Because Georgia is where the delivery occurred.

So the next time you're dealing with a transaction involving multiple states, it's really pretty easy to figure out the state you have to be concerned about. Just ask yourself, where was the delivery point?

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions.

Here's information on our upcoming seminars and webinars. Don't forget, we just announced our February to April schedule!

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment