This issue comes up a lot in seminars...

Usually, environmental equipment (keeping the lights on, maintaining a comfortable temperature in the plant, etc.) is taxable, even in states that grant exemptions for manufacturing equipment and materials. The problem is that, while necessary, the lights and temperature in the plant don't have a direct impact on the product being processed. If you want to make the argument that you need the lights on to operate the equipment, I'd agree with you. But you also need the sales and marketing department to keep the plant operating. That doesn't make them exempt. The rules are generally that the item must be directly used in the manufacturing process.

What does directly mean? This is not the rule in the majority of states, but it's my rule of thumb.

In order for an item to be exempt under manufacturing rules, the item must touch the product.I admit that's strict and most states aren't quite that nuts. But if you're going to argue for an item to be exempt before the Sales Tax Guy Tribunal, you'll need to rationalize from that statement. Good luck.

The Sales Tax Guy http://salestaxguy.blogspot.com

See the disclaimer on the right.

Don't forget our upcoming seminars and webinars. http://www.salestax-usetax.com and there's more sales tax news and links here http://salestaxnews.blogspot.com

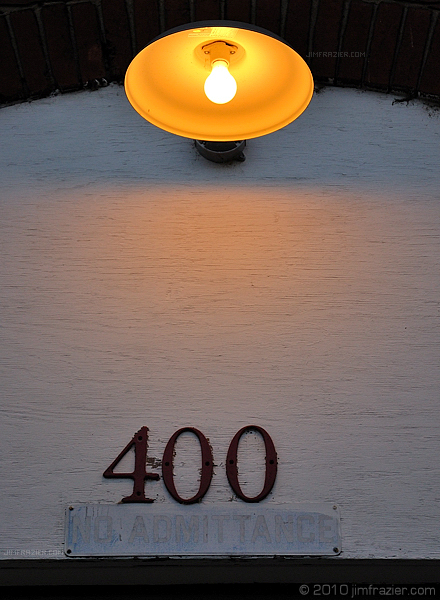

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment