There are excellent reasons for forming corporations:

1. There are obviously tax benefits.

2. Forming a corporation unifies and consolidates your business activities into one unit. That unit can then act as one, be sued, sue, purchase insurance as a unit, etc.

3. Corporations also limit the potential liability of the owners and facilitate easy changes in ownership (buying and selling stock,offering stock options, etc.).

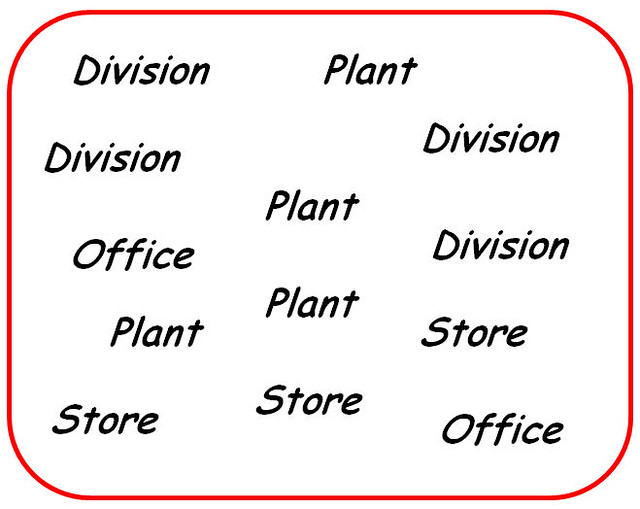

When there is a transfer of tangible personal property (and certain taxable services) within that corporation (see picture below), there is no sales and use tax impact. Merely transferring such things within your company creates no taxable event. The might be some additional use tax owed if you move something from a low tax jurisdiction to a higher one, but that’s about it.

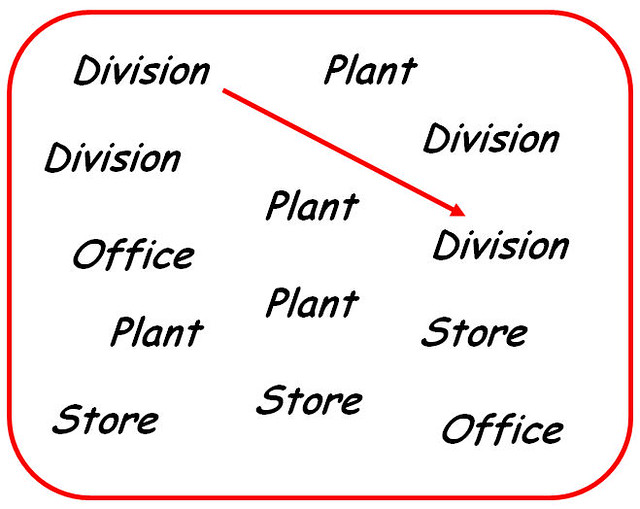

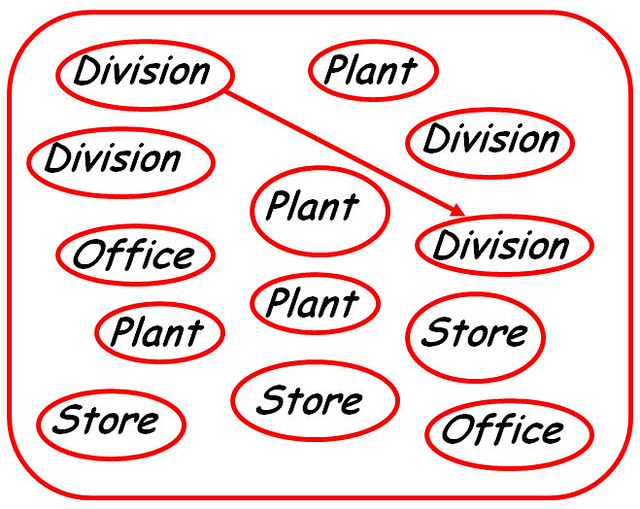

The problem occurs when you have subsidiary corporations within a larger corporation (see picture below). Those are all corporations that are owned, either partially or fully, by the parent. Now, when there is a transfer from one division to another, most states will consider that a sale. I repeat: a sale! That means that the transfer that you thought was just a journal entry on the books may become a taxable sale that you weren’t even aware of.

Companies form these subsidiary corporations for all of the same reasons that regular corporations are formed. And there’s one more reason – acquisitions.

Here’s the horror story:

Several years ago, a guy in, we’ll say, California invented a new machine. It was extremely expensive and it was new technology, so he was having trouble selling it. He finally got some venture capital together, and he started buying up small businesses all over the state and forcing the acquired companies to buy and use the machine. Since he wasn’t buying these businesses to be a tycoon, he left the previous owners in place as general managers, kept the local company names, and left the acquired corporations alone. All he was really trying to do was get his machine used.

He was successful. The machine worked wonderfully, did what it was supposed to do, and made the local businesses, as well as the corporate parent, a great pile of money. Yay!

The local divisions started moving the machines around. Sometimes a local office wouldn’t need one for six months, but the guy in the next county needed four of them for a year. So the machines got transferred from one division to another.

Then the revenuers came and all was lost:

1. When the inventor sold the machines to the local businesses, who, if you’ll remember, were separate corporations, he never charged sales tax. He, and his tax people, assumed that since they were all part of the larger parent corporation, sales tax wouldn’t be a problem.

2. When they transferred the machines from one subsidiary corporation to another, the state ruled that those transfers looked like sales. Which, obviously, nobody had thought of.

The assessment was for about $10,000,000.

I’ll just wait here for a second while you let that number sink in.

Yes, THAT bad.

When the company and their legal representation sat down with the state to talk, the state lawyers were confused. They didn’t know the lawyer across the table. Usually, at these conferences, it’s a sales tax lawyer and everyone pretty much knows everyone else. Who was this guy?

It turns out the owner had brought his bankruptcy attorney. They bluntly told the state that if they went through with the assessment, the company would have to go out of business.

The variations that you'll see among the states, and that might help if you're in a similar situation include:

1. Services between closely held companies may not be taxable in states where those services usually are taxable - leasing for example. In the above situation, if they had structured those transfers as leases, there may not have been any liability at all. And if the state didn't grant the leasing exemption, the tax liability would have at least been much less since it would only have been on the rental, not the cost of the machine every time it was moved.

2. States will frequently leave loopholes if the transaction between the two corporations doesn’t “look” like a traditional transaction – no exchange of consideration, the transaction recorded by a journal entry, etc. This probably would not have worked in this horror story since the owner had done nothing to integrate the accounting of the local corporations into the larger parent. Remember, he left the locals alone. All they had to do was buy and use his machines.

3. If the transaction meets the test of an occasional sale, the transaction may be exempt. That’s assuming you’re in a state where businesses actually can engage in occasional sales. In this situation, we're obviously not talking about occasional sales.

So the question is, are YOU making sales to your divisions? Are you transferring goods and taxable services from one unit of your corporate family to another part? If so, consider this as a warning…you better figure out what you’re doing. Look at your inter-company billing. Look at those transfer accounts. Talk to a good, local sales tax professional.

Some of the biggest assessments I've ever seen have been in this area. You've been warned.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the images above are hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment