Most of the sales tax news that I see these days seems to have something to do with states going after Amazon.com. The discussion includes other big Internet vendors - but I'll just say Amazon.com, because that's what everyone else says.

Many of the articles, letters, blogs, comments, and editorials go something like this:

"In order to be fair, Amazon.com should collect sales tax so that the local retailers, who have to charge sales tax, can compete fairly.

This opinion reflects a basic ignorance of the system. It's USE tax when it's an interstate shipment. I know, I'm being fussy, but the level of ignorance displayed drives me crazy. Now if they just took a few webinars...

There's also this common theme:

The state is out of money. If we can make Amazon.com pay taxes, we'll be in high cotton."

Which misses the point. The local customer is paying the taxes. Amazon.com is just being forced to collect it. Make no mistake...there is no shifting of the tax burden to Amazon.com.

And this one

"The state should fix this."

Which is wrong. The states have been trying to do this with aggressive nexus assessments and silly laws involving "associates" in the states. It hasn't worked out really well. The states can't fix this. It's an interstate commerce issue.

But every once in a while, someone makes the correct observation:

"Congress needs to fix this."

Now they've identified the problem. Congress (or the Supreme Court) can fix this by making nexus much simpler. All those "Main Street" local retailers argue that if Amazon.com ships into a state from out of state, they have to charge the local state's tax. OK, Congress can wave the Magic Nexus Wand and make this the law of the land:

Regardless of their physical presence in a state, the seller must charge the taxes for the destination state and remit the taxes to that state.

Nice and simple. And fair.

Full disclosure: I don't want this to happen. Then nobody will sign up for my nexus webinar. I much prefer it complicated. ;-)

But, please remember that all those journalists, editors, chambers of commerce, and local businesses are clamoring for fairness.

Well, folks, here's the part that you don't realize you're wishing for.

If you're like most "Main Street" businesses, you also have a web site. And that almost always means that you sell stuff outside of your state. Guess what? YOU will have to start charging tax on your shipments too. Yep. You want it to be fair, don't you? If Amazon.com has to charge taxes when they ship into your state, and steal your business; then YOU should have to charge taxes when you ship into some other state and steal someone else's business.

I can just hear the howls of protest:

"Oh, no. There will be a dollar limit. Only sellers who have annual sales in excess of $100,000,000 will have to deal with this 'fairer' rule."

That doesn't sound fair to me. And it doesn't sound fair to that guy in the other state whose business you've stolen.

I also wonder if the newspaper publishers who are demanding this "fairness" realize that some of the states where they sell subscriptions actually do tax newspapers. Which means even THEY will have to start charging taxes and filing in those states. And, of course, the famous newspapers probably sell hats, t-shirts, etc. from their web pages. Guess what? Hee hee hee.

And for the politicians. Your constituents, George and Martha, will suddenly be unhappy when they realize that "making Amazon.com pay sales taxes" really means that George and Martha will have to start paying those taxes. Amazon will lose business because they have to charge tax. But George and Martha will have to pay it.

Be careful what you wish for.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

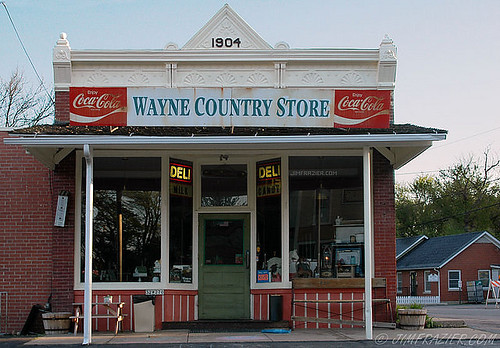

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment