There have been some stories this week about some problems that Amish are having with a new rule in New York requiring EVERYONE to file electronically. This means the Amish too. This is a pretty thorough article. While it makes for a good story, I'm not sure it's that big of a deal.

I've always found the Amish culture interesting and have read about it over the years. And I've even done sales tax seminars for them. One thing to keep in mind is that Amish rules are very intricate and convoluted. It's not so much that they have a problem with electricity, but that they have a problem being connected to utility lines, which connects them to the outside world, which weakens their community. For Amish, preserving their community is paramount. And admirable.

So they don't have phones or utility-provided electricity. But you'll often see public telephones near their communities. And they may use battery or generator powered electric devices in their shops and on their farms. But it's all highly variable. They make these decisions locally and some groups are stricter than others.

I have a friend whose company has more than a few Amish customers. There's usually a problem because they can't use the internet, web or email, have trouble faxing in orders, and the mail is too slow. They can't take digital pictures of damaged goods and email them for the obvious reasons. She can't call them back when they leave a message because, well, they were standing at a pay phone. But she tells me that they are almost invariably the nicest customers to deal with.

So what has this to do with electronically filing sales tax? They can't. Period. Electronic filing requires a computer, internet connection, email and the web. They don't do any of those things. So what's the solution?

As the article I mentioned above shows, after some prodding of a typically unresponsive and resistant government bureaucracy, they were told that they can still file their returns by mail. And here's the other thing. Most Amish have accountants. THEY can do all the things necessary to file electronically.

Electronic filing is a good thing. It helps avoid errors, and allows the government to cut some staff that were doing data entry. Making the "G" more efficient is highly desirable, if unlikely. Plus, in this instance, the rule gives more business to local accounting firms. Which is a wonderful thing.

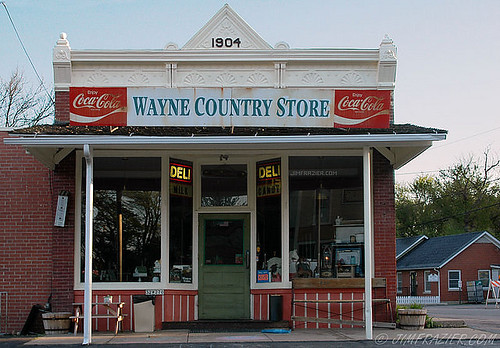

So don't worry about the Amish (I'm guessing you weren't). I'll be honest, the real reason I wrote this was to use that nice picture I took in southeastern Pennsylvania. And to dazzle you with my knowledge of things that have no relationship to sales taxes.

Have a glorious day. I don't know about where you are, but here in the western suburbs of Chicago, it's a beautiful day. Why are you reading this blog? Go outside and play! Go on, git!

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.