It felt like

the alarm clock went off early today.

Halloween went way too long last night.

It was fine for a while - the usual little kids saying, “trick or

treat.” But it got annoying when the

doorbell kept ringing after 9pm, the official citywide cutoff. And it got a little more annoying when the

later visitors looked bigger and scarier than the little kids. I mean, some of these "kids" were

over 6 feet. And they had much more

frightening masks than what the little ones were wearing. And when they said, “trick or treat,” their

voices sounded like they had all left puberty in the dust several years

ago. Frankly, the late comers made me

glad I had that baseball bat in the corner behind the door - particularly since

I almost ran out of candy.

Luckily I had

bought a really big supply. Amazon had a

sale on Halloween candy so I got it really cheap and didn't even have to pay

sales tax on it. Yeah, I know I'm

supposed to pay use tax when Amazon doesn’t charge sales tax, but really,

come on.

I also had the

brilliant idea of getting salt-water taffy.

I always eat way too much of the Halloween candy (I mean, it's sitting

right there), but since I have more than my share of expensive dental work, I

stay away from things like caramels, Jujubes and taffy. But I figured the kids wouldn't care.

I finally got

to bed, only to be awakened a few times during the night by a pretty nasty

storm that came up all of a sudden. It

still looked and sounded pretty much like the end of the world as I left my

building and started my short walk to work.

I could have hit the snooze alarm and slept in a little, but I had a

weird sense that I’d better get to work as soon as possible.

The storm was

still crashing around me. There were

branches in the street, rain was pouring, mostly from the side, and cars were

going through big puddles. People where

hurrying, huddled in their hats and coats.

Umbrellas were a waste of time in weather like this. In fact, almost every trash barrel I passed

had a couple of broken ones jammed into them.

Normally, my

walk takes 10 minutes, but today it took almost half an hour. I had to walk into the blowing wind, squint

through the driving rain, hold on to my hat, try to avoid the splashing water

from the cars, and keep looking behind me.

You see, after a few minutes, I got the feeling there was someone following

me. I couldn't hear anything unusual,

what with the storm, but I definitely got the feeling that I was being

watched. So I kept turning around.

Only once did I

see someone who appeared to be following me.

He was a tall, erect figure wearing a black coat with a black derby. He was on the other side of the street and he

didn't stop when I turned. In fact, it

didn't seem like he cared whether or not I saw him or not. The rain and wind were so heavy that I could

only barely make him out. Not wanting to

get a closer look, I kept going. It was

weird though. He wasn’t walking fast, or

hunkered down like everyone else. And

how did he keep that hat on? I kept

looking back for another glimpse, but the weather was on his side.

Once I got to

the office, the door was locked. I was

early, after all. I tapped on the door

for the security guard. He wasn't

there. I didn't realize how nervous I

was until that moment. Here I had some

guy following me, and that weird desire to get to work early was getting worse. So I waited outside under the overhang - at

least I wasn’t getting wet. But I was

working up a cold sweat, just from nerves.

I kept looking for the derby-guy, but he wasn't there. I still couldn’t make out anything more than

a few yards away. And where WAS that damn

security guard? And why did it seem so

important for me to get to work?

Finally, the

door opened and, taking one more look for the derby-guy, I hurried inside past

the guard. I headed for the

elevator. Normally, I try to take the

stairs, but they're kind of dark and I have seen enough movies to want to avoid

them, since I seemed to have a stalker.

Plus the elevator would be faster, since I REALLY needed to get to my

desk.

Just as I had

gotten onto the elevator, a hand reached in and stopped the doors from

closing. I whirled around, and uttered a

squawk of fear and surprise!

It was the

guard. "Sorry to startle you. There was someone here about 15 minutes ago

asking for you. I said you hadn't come

in yet. He said something about being

back. I just thought you should

know."

Catching my

breath, I said "Thanks." Then,

thinking about my hat-wearing buddy, I asked, "Was he wearing a weird

hat?"

"Yeah, now

that you mention it, he was wearing one of those old style derby hats. Not a trilby like the guys in marketing wear,

but something out of the last century.

And he was really tall."

Uh, oh. He had beaten me to work! At the same time he had been out on the

street following me to the office. Oh,

crap! "Did you see what he looked

like?"

"No, he

had his collars pulled up so I really couldn't make anything out. And he had sunglasses on, which, given the

weather, was weird.”

"Listen,

don't let that guy in. If he shows up,

call me. But don't let him in. If you have to, call the police."

"OK, but

the police won't be much help. They're

running around dealing with the storm, plus there was a weird guy

trick-or-treating last night and they're trying to find him."

"Tell the

police this guy might be the one they're looking for."

I went up to my

office, unlocked the door and let myself in.

I pulled off my coat and sat in my chair - relieved. Except that it occurred to me that there

wouldn't be anyone in for at least another hour. So I closed the door and locked it. And I pulled a chair up against it and wedged

it under the doorknob. I don’t know if I

did it right, but it looked like what they do in the movies, so I figured it

might work.

Feeling a little

safer, I sat down again and took a look at my desk calendar. I'm sort of a Luddite so I still use one of

those one-page-a-day versions. I flipped

the page to November 1 and thought, "Oh, my God!" It said, "sales tax auditor at 9am." You know those dreams where you're back in

school and there's a test and you didn't even know you were supposed to take

the course? Well, I had completely forgotten

about the audit. And the auditor had

given me a long list of things to have ready for him. I had completely forgotten. "Oh, crap, oh, crap, oh crap..."

There was a

knock at the door.

Did you know

that they never have those little peepholes in office doors? I was really wishing for one now. "Yes?" was all I could squeak out.

"I'm

looking for Mr. Frazier," came a low voice, really more of a loud whisper.

"Uh,

that's me. Hold on."

I moved the

chair from door, and opened it. There he

was: derby-guy. He was really tall and

he still had the sunglasses. He was

lifting his arm towards me. I almost

fell over the chair as I backed away.

He held out his

card and whispered "I'm Herman Mudgett, with the Department of

Revenue." I was staring at him in

stunned silence. "I'm here to do

your sales tax audit." And with

that, he walked into my office and sat at MY chair.

I stammered

out, "How did you get in here?

The guard should have stopped you!"

"Oh, we

have ways of getting in where we're not welcome. It’s part of the job." And with that he swept everything off my desk

onto the floor - the calendar, my paperwork from yesterday, everything.

"What the

hell?" I yelled. My fear had gone

to anger in an instant. Who was this

jerk?

"Have a

seat, Mr. Frazier." he said. His

voice had taken on a low, evil, snarling tone that made me sit down, right on

the wet raincoat I had thrown on the chair a few minutes ago.

He opened up

his bag and all I could see in it were two boxes. One was very shiny and had one knob and one

dial. The other was a small cardboard

box.

I said

tentatively, "I'm afraid I'm not ready for you. I completely forgot you were coming. My bad."

"Oh, I'm

not here about that," he croaked out.

“I'm here about the use taxes you didn't pay on the Amazon candy you

handed out last night."

I gasped. "How did you..."

He cut me off,

opening the small cardboard box, "…and I'm here about that taffy." He

showed me a piece of salt-water taffy, with a bloody tooth embedded in it.

Then he hissed,

“Just so you know, dental appliances ARE taxable in this state.”

---

Happy Halloween from The Sales Tax Guy

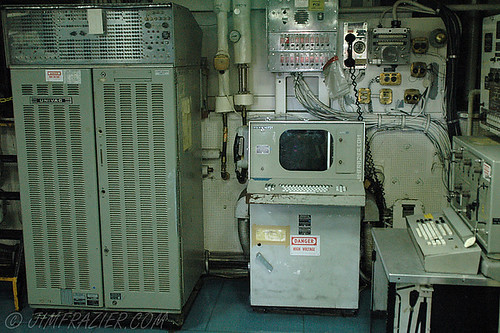

PS. Thanks for sticking with us. It's been a very busy summer. There have been lots of webinars to do, a few on-site seminars, one hospitalization, a stolen car, and a vacation. All in all, there hasn't been a lot of time to devote to the blog. But we're trying something new. It's been testing for over a month and just might work. It's not ready for prime-time yet, but if you made it this far, you deserve a sneak peak.

Again, thanks for your support.

Every newspaper, every chamber of commerce, and every main street type organization, at some point in time, feels the need to editorialize about how horrible it is that Amazon.com and other online vendors are damaging the business of local retailers. You see, in case you have spent the last decade under a rock, that there are a couple of clauses in the Constitution that prevent states from making out-of-state sellers collect tax. Unless they have nexus, of course. And, since it's just some journalist who has no clue what the real issues are, they usually get it wrong.

Every newspaper, every chamber of commerce, and every main street type organization, at some point in time, feels the need to editorialize about how horrible it is that Amazon.com and other online vendors are damaging the business of local retailers. You see, in case you have spent the last decade under a rock, that there are a couple of clauses in the Constitution that prevent states from making out-of-state sellers collect tax. Unless they have nexus, of course. And, since it's just some journalist who has no clue what the real issues are, they usually get it wrong.