As I've been perusing the news, one particular problem, which is eminently solvable, keeps coming up. So let me just say now: make sure you know what the paperwork requirements are, that you fill out the proper forms, and that you do things ON TIME!

Three examples:

Numerous sales and use tax appeals are lost because the businesses who suffered the assessments didn't file the necessary notices on time. Come on! And don't rely on the auditor to tell you what your deadlines are. I've seen at least one situation where the auditor gave incorrect information about the appeals process. When the taxpayer used that as an excuse, the courts basically said, "tough." Independently verify what you need to file and when you need to file it.

Enterprise zones, opportunity zones, etc. give nice sales and use tax exemptions, usually for businesses located in economically distressed areas. But there's paperwork and approvals that you must fill out and file.

And the classic example of paperwork that most of you are failing to get - exemption certificates. Get them. Remember that some states don't have to give you any time to get them when the auditor shows up. And you won't be able to get them from some of your customers when you ask. So get them now!

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

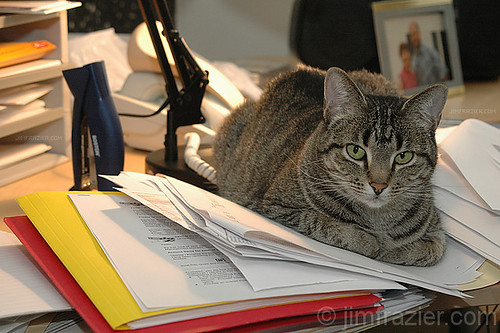

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment