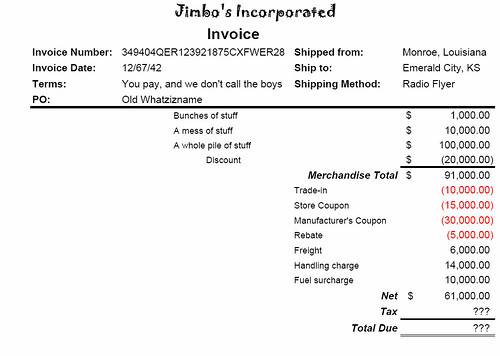

Once we have determined that a sale is taxable, there remains another problem. We are going to add sales or use tax of, say, 7%. But 7 % of WHAT?

The invoice above is taxable because stuff is always taxable (that joke sounds better when I do it in the seminar - trust me). So obviously the 7% is going to be applied to the merchandise total of $91,000. But what are we going to do with those extra things, like coupons, rebates, freight charges, etc.

The rule is generally known as basis of tax - what we are going to take 7% of. Basis of tax deals with the extra items on an invoice, that is already taxable, and whether those items will be added to the basis or subtracted from the basis. So here's the actual golden rule:

All of the charges on a taxable invoice will be added to the tax basis and are therefore taxable. But all of the deductions from a taxable invoice will NOT reduce the tax basis...they have no effect on the tax.

This sounds unfair. But when you start taking apart these rules in each state, you'll find there are LOTS of exceptions. But it's helpful to start with the assumption that any charges will be added to the taxes. But deductions do not reduce the taxes.

Also, remember - this rule is only relevant if the sale is taxable. If the sale (or purchase) wasn't taxable, then forget about it. Move along, nothing to see here. We don't care about those extra items...there is no basis of tax if there isn't a tax in the first place..

For example: If I'm charging a customer freight for a shipment of no-charge parts that are covered by a warranty, then the sale isn't taxable. And the freight charge won't be taxable either. If there is no taxable sale, there's no tax. And there won't be any basis. So you're finished.

That's the theory, anyway. I have seen some weird spins on these rules, so it's important to check the applicable state's rules to make sure you're not missing anything. For example, some states will say that installation charges are taxable, regardless of the taxability of the sale of the stuff being installed. Go figure.

Sales Tax Guy

| See disclaimer |

We have more articles on the basis of tax.

| Here's information on our upcoming seminars and webinars |

| And please don't forget to visit our advertisers! |

Picture note: the illustration above is hosted on Flickr. If you'd like to see a larger version, click on the picture or the Flick link, then click on the "all sizes" button above the picture.

.

No comments:

Post a Comment