I was doing an on-site seminar earlier this week, and one of the things that came up, that I thought would be worth mentioning here, is that things change. The problem is that we make decisions about sales and use taxes (along with everything else) and then move on. A few years pass and things have changed. But those decisions are still in place. And if someone asks about it, you say, "Oh, we decided about that years ago."

I was doing an on-site seminar earlier this week, and one of the things that came up, that I thought would be worth mentioning here, is that things change. The problem is that we make decisions about sales and use taxes (along with everything else) and then move on. A few years pass and things have changed. But those decisions are still in place. And if someone asks about it, you say, "Oh, we decided about that years ago."Have you reevaluated the situation to see if the sales tax situation has changed?

Here are just a few things that immediately spring to mind where you might make a decision, and see the situation change, resulting in a serious error down the road.

Nexus

A couple of years ago, you decided the the presence you had in a state did not mean you had nexus. You were even right! But then, over the years, you have more sales people visit the state, you start renting equipment in the state, do some seminars, send your own trucks into the state, or some court cases are decided which result in you now having nexus.

And then, there are the new states you're in that you haven't even considered.

Taxable services

You've determined that the services you offer aren't taxable in the states where you sell. But are you subscribing to a tax newsletter to make sure that the state doesn't make those services taxable? States are constantly looking for ways to expand their tax base and adding taxable services is one of the ways. If you're not staying up to date, you're in for a surprise.

Occasional sales of equipment

In the past, you've occasionally sold the odd piece of equipment. Those were occasional sales in most states. But your business has grown and now you're an equipment dealer. I just wrote an article about this last week.

The moral? Periodically you should take a big picture look at your past sales tax decisions and see if anything needs updating. Don't assume that the decision you made a couple of years ago is still good.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different. Here's more information

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Don't forget our upcoming seminars and webinars.

http://www.salestax-usetax.com/

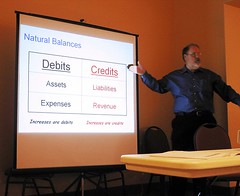

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

No comments:

Post a Comment