Common carriers are regulated companies that haul people and/or goods for money. They offer their services to the public and will theoretically haul for anyone. Hence the name, "common carrier." On the other hand, a "contract carrier" offers their services to a small group of clients and can refuse customers.

Here's a good discussion on Wikipedia.

So who are common carriers?

Air carriers

Note we're talking about American Airlines and Fed Ex, not the local charter service.

Trucking companies

There are some contract carriers in this category, particularly delivery services.

Railroads

Ships and ferries

NOT charter fishing boats. This category would included ships destined for foreign ports and, in some states, barges.

And depending on situation, taxis and car services, telecommunications and pipeline companies have been referred to as common carriers.

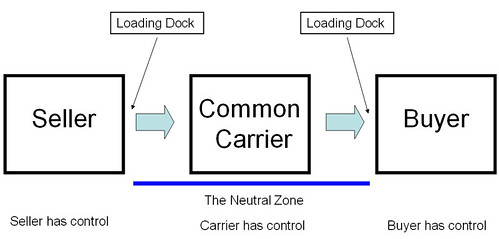

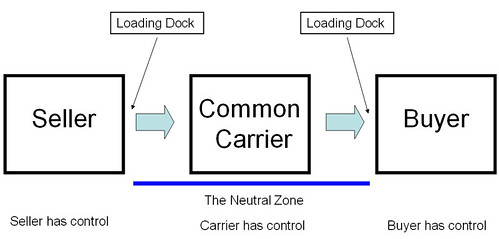

The Neutral Zone

The "neutral zone" comes into play when an interstate delivery occurs. In an interstate sale, if a common carrier picks up goods in Florida and delivers them to Nebraska, the delivery point is considered Nebraska, even though they left the seller's control in Florida. This is the case in most states, even if the buyer hired the common carrier.

And it makes sense. If the essence of "use" for use tax purposes is "control," then the buyer has no control until the truck pulls up to their dock. The control of the goods passes from the seller to the common carrier at the seller's dock. The goods remain in the control of the common carrier until they arrive at the buyer's dock. At that point, the buyer takes control of the goods.

At no point, even if the buyer hired the common carrier, can the buyer stop the train carrying his shipment and tell the conductor, "My shipment is on your train. I want it now please." In other words, the buyer has no control, therefore did not use the goods.

So, the common carrier is a neutral zone where, even though the seller has shipped the goods, the buyer still hasn't taken control of the goods. No use tax is imposed on the buyer while the common carrier has delivered the goods.

Having said that, there are a couple of states that pretty much say that if the common carrier was hired by the buyer, then the common carrier is acting as the buyer's agent and the buyer does take delivery at the shipper's dock. But that is unusual.

Common carriers have exemptions

The second thing to remember about common carriers (particularly railroads, ships and air carriers) is that they have exemptions available to them based on how they will use the purchase - if they're going to use it directly in interstate commerce. For example, air carriers can generally buy their planes and parts tax free. Ditto for railroad rolling stock and large ships. The exemption is less common for trucking companies. Some states don't grant any exemption for "over the road" trucks and parts delivered in the state. Or the exemption may be based on mileage outside of the state versus inside the state.

It's also worth noting that some states, like Idaho, don't have an exemption for large ships. I haven't figured out why. But if someone knows. please contact me. ;-)

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions. Remember: there are details we haven't discussed, and every state is different.

Get these articles in your inbox - subscribe at http://salestaxguy.blogspot.com

Here's information on our upcoming seminars and webinars.

http://www.salestax-usetax.com/

Picture note: the image above is hosted on Flickr. If you'd like to see more, click on the photo.

2 comments:

How can I ascertain with total certainty that the trucking company I have chosen will be considered a common carrier should we be audited. This is important for my company because most of our customers are out of state and only have resale certificates in their home states or in the states where the product is shipped to.

Way beyond my knowledge. Have a look at the wikipedia article.

BUT, I'm not sure this is a big deal. If you can demonstrate that you did in fact ship the goods out of the state, most states will say the the delivery occurred out of state. This would be regardless of whether or not it's a common carrier or your own truck. Therefore, the certificate from the delivery state should be enough.

Except...

Note that, as mentioned in the article, if the customer arranges for the common carrier, or picks it up themselves, it can get complicated in some states.

Post a Comment