This is part 3. Here is part 2. Please start this series with part 1.

When last we left our hero, the great state of Texas, they were just trying to get their money from somebody. As we saw in part 2, there was a good chance that Brad wouldn't pay the use tax on the motor he bought from Jennifer because he was, well, stupid. We'll give him the benefit of the doubt. He just didn't know.

But maybe Texas can get Jennifer to collect it from Brad. Maybe.

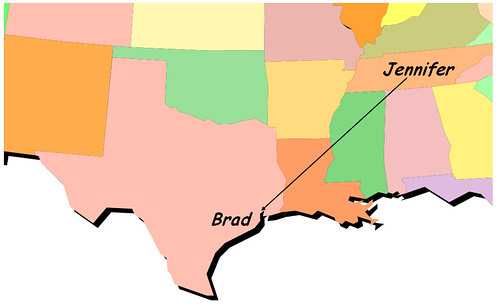

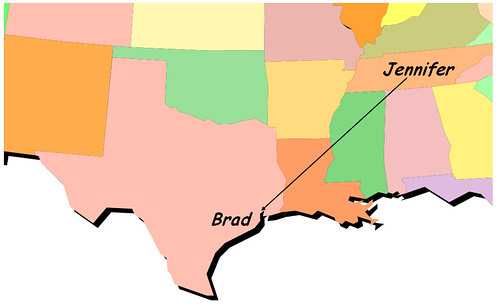

To refresh your memory, here's the transaction:

The problem for Texas, as things stand, is that they can't make Jennifer collect tax from Brad. They can't make Jennifer collect sales tax because of that darned Constitution that we mentioned in part 1. And they can't make Jennifer collect Brad's use tax because Jennifer is in Tennessee! She isn't in Texas. They have no jurisdiction over her.

Now there are a lot of situations where a state can reach across a border and grab someone by the collar. But this isn't one of them. Jennifer is in Tennessee. Based on what you know so far, Texas can't touch her.

So they're still out the taxes.

But wait!

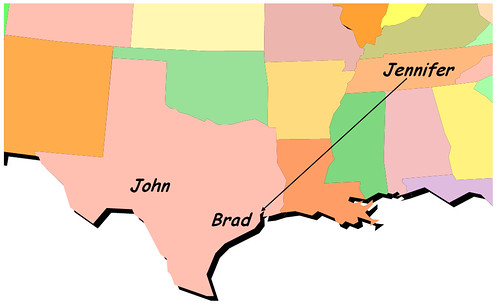

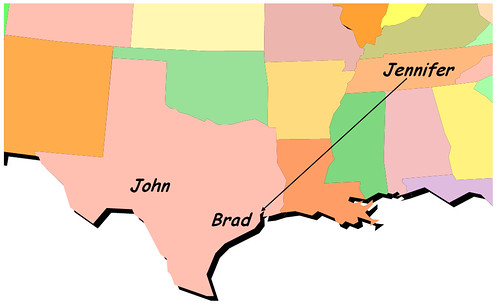

Jennifer has a sales rep - John.

John visits Texas five or six times a year. He flies into Dallas, drives around for a few days and flies out of Houston. Now Jennifer is in trouble. John's physical presence in Texas gives Jennifer nexus in Texas. Texas can now make Jennifer collect the use tax from Brad and remit the money to Texas. Yay!

So to summarize:

1. Angelina charged Brad sales tax because it was an intrastate sale in Texas.

2. Jennifer didn't have to charge Brad sales tax because it was an interstate sale and the Constitution restricts the ability of states to tax interstate commerce.

3. Brad owes tax on his use of the motor once he receives it in Texas

4. Brad probably isn't going to pay that use tax.

5. Texas would really like to get Jennifer to collect that use tax.

6. Which they can now do because Jennifer has a physical presence in Texas - nexus.

When the sale is intrastate, the tax that usually applies is sales tax

When the sale is interstate, the only tax that can apply is use tax.

And to answer the question that has lead all three of these articles, it's Texas. It was Texas when it was an intrastate sale. And it was Texas when it was an interstate sale because the only applicable tax in that situation is use tax. Which obviously can only be imposed in the state where Brad receives the goods. So the golden rule is that the state where the buyer receives the goods will be the state that imposes the tax.

Thank you for your patience. No more mini-courses for a while. Although, I like the maps. So you'll see those again. Real soon.

The Sales Tax Guy

http://salestaxguy.blogspot.com

See the disclaimer - this is for education only. Research these issues thoroughly before making decisions.

Here's information on our upcoming seminars and webinars.

http://www.salestax-usetax.com/

7 comments:

Wow... great mini-lesson! It was clear, concise yet thorough, had very good examples, and was even entertaining! I hope you have more of these. The lesson really helped clear up the logic behind processes that people/companies just follow, and do not understand. I love how you identified that A/P knows to accrue sales tax simply because they did it at their old job but has no idea why! haha... Thanks again.

very interesting - many thnaks. But one question I have is what defines the place where recipt occured. For example, most cases where things are shipped, the Seller and buyer agree on who takes care of carriage and when title transfers (See the Incoterms definitions), so If Seller ships the products FCA Origin, rather than FCA Destination, wouldnt that mean that the article transferred to the Buyer in the state of the seller - not the destination state. How would this affect the taxation?

very interesting - many thanks. But one question I have is what defines the place where recipt occured. For example, most cases where things are shipped, the Seller and buyer agree on who takes care of carriage and when title transfers (See the Incoterms definitions), so If Seller ships the products FCA Origin, rather than FCA Destination, wouldnt that mean that the article transferred to the Buyer in the state of the seller - not the destination state. How would this affect the taxation?

very interesting - many thanks. But one question I have is what defines the place where recipt occured. For example, most cases where things are shipped, the Seller and buyer agree on who takes care of carriage and when title transfers (See the Incoterms definitions), so If Seller ships the products FCA Origin, rather than FCA Destination, wouldnt that mean that the article transferred to the Buyer in the state of the seller - not the destination state. How would this affect the taxation?

sorry for the multiple posts - the word verification notice keeps saying that I didnt type the word correctly, so I kept re-posting. I hadnt realized that it was posting the comments anyway. Someone should fix that bug.

FOB point is usually irrelevant because it doesn't describe where the real transfer of PHYSICAL control occurs. It's nice to have it agree with reality, but usually not critical.

http://salestaxguy.blogspot.com/2006/06/golden-rules.html

Hey thanks Jim -

Post a Comment